Recently I reviewed the American Express Personal Platinum Card along with the most recent changes to the card features. Unfortunately Amex has clawed back the welcome bonus from 60,000 points to 25,000 points (although the minimum required spend has also been dropped by $3,000). Bonus points for referrals were also reduced by a third from 15,000 points to 5,000. Similar reductions were made to the Business Platinum card as well.

Recently I reviewed the American Express Personal Platinum Card along with the most recent changes to the card features. Unfortunately Amex has clawed back the welcome bonus from 60,000 points to 25,000 points (although the minimum required spend has also been dropped by $3,000). Bonus points for referrals were also reduced by a third from 15,000 points to 5,000. Similar reductions were made to the Business Platinum card as well.

Some of these changes were understandable given the economic downturn and business objectives of Amex. At the same time it was disappointing to anyone who was considering getting the card for the bonus incentives or renewing their card membership. Disappointing in the fact that many of the usual benefits (of what is really a premium travel card) are not particularly useful at the moment with the many travel restrictions currently in place. Not to mention general uneasiness most people have currently with travelling to airports and hotels.

But wait… Great New Offers Arrive!

Fast forward a few weeks later and American Express has suddenly emerged with new offers to help take the sting out of the devalued travel benefits, which were somewhat out of their control. For those not aware, American Express cards generally have “offers” which you can register your card for and take advantage of in your account management area. Usually these are offers on slightly obscure or higher end retailers that already charge big markups, so the savings are generally not great unless you had a planned purchase from one of these stores. Things have changed however!

The American Express Personal Platinum card has just introduced a great new offer of up to $250 in statement credits for every dollar spent at select Grocery stores such as Longos, Metro and others. This is basically a free $250 in groceries when it comes down to it. If you spend that amount on groceries at these locations, you will get it back in statement credits (excluding some items such as gift cards, lottery tickets, cigarettes, etc..). As far as I’m aware, this is for in-store purchase and many of these location do not have grocery pick up available. However, it is valid for Grocery Gateway, which is owned by Longos who is included in the promotion, so you can still take advantage of this offer if you aren’t ready to go back into a grocery store just yet.

These types of offers certainly help make up for the $699 annual fee and may also entice people to renew their cards in hopes of future offers to take advantage of and offset their fees, while retaining many of the travel and points benefits. Other offers currently available to the card are some small wins such as $5 in credits for $10+ spent on Uber Eats, Skip the Dishes and Instacart.

Other Card Offers

American Express has also recently reduced referral bonuses and welcome bonuses on their Business Platinum and Business Gold cards. Fees however remained the same, and the Business Platinum card specifically could be argued to have much less value as well with travel restrictions mitigating its usefulness and rewards potential. But wait…. there’s more! Amex has also introduced some great new offers to these premium cards as well.

Business Platinum

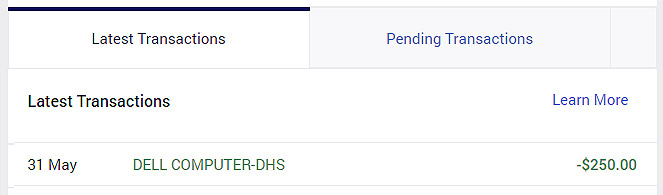

The Business Platinum card is now offering a $250 credit to Dell Computers when making a purchase of $250 or more. It’s as simple as registering for the offer, then making a valid purchase of $250+ on the registered card. I’ve already taken advantage of this and while the terms and conditions stated the credit may not be applied for a couple months after the promotion, mine was applied almost immediately after purchase. Who can argue with $250 in free products for the office?!

Another very useful deal is an offer for a $40 credit when spending $40 on “mobile service providers” – up to 4 times. This could be your cellphone bill for example – obviously. So by taking advantage of 4 payments, you will save a total of $160 on your cell phone bills.

Finally we have a similar offer of “spend $45 get $45 off” up to 6 times with FedEx! That’s another $270 potentially in statement credits.

There was an email that went out from Amex about a month ago stating new offers coming, up to $680 in value. I was skeptical on the actual value and usefulness, but personally I think Amex has knocked it out of the park with this as well as the Personal Platinum offer.

Business Gold

For those holding an Amex Business Gold Card, you can register your card for 10% off Dell Computers (up to a maximum of $1,000). This is not as great a deal as the others, but at the same time it’s still an extra 10% off and the fee for the Business Gold card is not in the same category as the Platinum Cards.

The Gold card is also offering similar deals as the Personal Platinum card with $5 off with $10 spent in various food/restaurant services.

The Amex Business Edge Card is offering some discounts to retailers in the range of 15-20%, basically standard card offers. The Marriott Bonvoy Card has an offer for 15% off clearly.ca for glasses and contacts. These are the more generic type of offers and the savings normally seen with such promotions.

Others Notes

PC Financial

For those who are fans of Loblaws stores, Shoppers Drug Mart or PC Points, get your PC Financial Mastercard® before June 28th if you don’t already have one!

PC Financial is now offering a 100,000 PC Optimum Points sign up bonus for their cards after your first purchase (and paying off that purchase). For anyone interested in collecting PC points or those that do a lot of shopping at these stores, this offer should be a no brainer. The three card options, specifically the World Elite will help you earn points more quickly at PC brand stores with 30 points for every $1 spent at Loblaws and partner grocery stores, and 45 points for every $1 spent at Shoppers Dug Mart. Not bad!

Conclusion

The Credit Card landscape is always changing with new deals arising amidst competition. It’s clear that in order to get the best deals whether it be in the form of products and promotions or cash back – you have to keep your ear to the ground and be aware of the options available. If rewards are important to you, try reviewing your cards every six to twelve months to ensure you’re getting the best value for your money. Many times product switching is also an option if you don’t want to open new accounts or acquire new cards. Ask your bank or card provider if there are new or alternative card options available that you can switch to. Over time these rewards all add up. Happy saving!