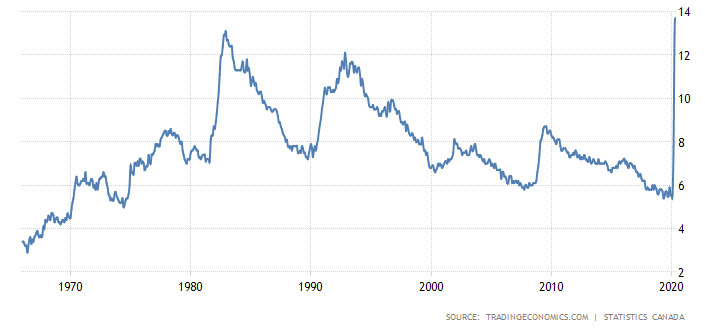

With all that said, there are still potentially and more than likely going to be lasting effects on the economy both in North American and globally. And while the unemployment data may recover and not be at ridiculous off the chart levels, it will likely still be higher than normal.

It makes you wonder why the market has trimmed losses so quickly. I suppose with interest rates retreating to abysmal levels, equities seem to be the most attractive option for potential returns at the moment if you are looking to invest your money. Also, while overall index losses have been pared, it seems to be quite skewed towards large tech companies, whereas other sectors are still severely lagging. Proceed with caution.

To me the current market is dicey and I am more than happy to have cash on the sidelines. Canadian banks have recently reported quarterly profits chopped in half, but the numbers were slightly better than analysts expected, so of course the financial stocks are up. It is concerning though if you look at what is set aside for loan losses versus the potential losses that may occur.

Canadian Dividend stocks have also been hammered with 88 TSX listed companies either cutting or suspending their dividends at the time of writing this. See the full updated list here – Canadian Companies that Cut their Dividends

In any event, I’ll refrain from a complete market commentary but did want to review an article posted exactly 2 months ago with my 5 Beaten Down Canadian Dividend Stocks to Consider. I’m actually shocked how quickly some have recovered, so I thought I would provide a quick update on their returns and which of these I am still holding in my portfolios. I’ve also noted a few new purchases I’ve made this month.

as of market close on FRIDAY JUNE 5, 2020

(approximate returns not including dividends)

Enbridge

THEN: ENB.TO (SP/$38.63 – Yield 8.39%)

NOW: ENB.TO (SP/$44.84 – Yield 7.23%)

RETURN: +$6.21/share (+16%)

Enbridge has been a solid performer and continues to have an attractive dividend. With the recent overall TSX / S&P market gains and less in the way of what I would consider attractive “value” opportunities I am considering now adding to my position in ENB on a pullback. Currently I am still holding the approximate 1/3 position originally purchased.

Brookfield Asset Management

Brookfield Asset Management

THEN: BAM-A.TO – (SP/$39.60 – Yield 2.42%)

NOW: BAM-A.TO – (SP/$48.72 – Yield 1.40%)

RETURN: +$9.12/share (+23%)

Brookfield Asset Management has also not disappointed, although it has been a little more volatile in recent weeks. This will continue to be a long-term hold for me unless fundamentals drastically change, this is still a very small position overall.

Royal Bank

Royal Bank

THEN: RY.TO (SP/$83.05 – Yield 5.20%)

NOW: RY.TO (SP/$96.80 – Yield 4.46%)

RETURN: +$13.75/share (+16.6%)

As I mentioned in my previous note, I was cautious on banks and still am. I was lucky with RBC and made a reasonable return quite quickly and decided to allocate those funds to TD Bank instead as it had lagged, and initially was my “toss-up” second choice to RBC. Banks have had a good run in the last two weeks thanks to better than expected results and continue to pay attractive dividends. The economic backdrop is still concerning with potential defaults and bankruptcies across many sectors.

Canadian Natural Resources

Canadian Natural Resources

THEN: CNQ.TO (SP/$18.48 – Yield 8.11%)

NOW: CNQ.TO (SP/$28.86 – Yield 5.81%)

RETURN: +$10.30/share (+55.7%)

Oil has had a fantastic recovery considering the demand destruction from COVID-19. CNQ continues to pay a substantial dividend yield, which had been in question as Suncor cut their dividend 55% recently. Similar measures have been taken by industry giant Royal Dutch Shell cutting their dividend for the first time since 1945 by a whopping 66%! Prudent conservation of balance sheet strength you could argue. I am still holding CNQ and have actually doubled my original position about two weeks ago as I continue to have confidence in rising oil demand and subsequent price recovery.

Methanex

Methanex

THEN: MX.TO (SP/$16.33 – Yield 12.37%)

NOW: MX.TO (SP/$32.11 – Yield 0.77%) (Dividend Cut 90%)

RETURN: +$15.78/share (+96.6%)

Methanex was a bit of an outlier choice, and while the dividend was almost completely eliminated, the capital appreciation has more than made up for the distribution loss. The stock is up almost 100% since my original article. I still like the prospect of further capital appreciation now that the dividend has been slashed, but I sold my position in Methanex to take profits and lessen my overall exposure to energy, as I am already overweight the sector.

NEW INVESTMENTS:

Sienna Senior Living

SIA.TO (SP/$11.06 – YIELD 8.46%)

Western Forest Products

WEF.TO (SP/$0.84 – YIELD 10.71%)

(Dividend suspended)

Loblaws

L.TO (SP/$67.46 – YIELD 1.87%)

TD Bank

TD.TO (SP/$65.01 – YIELD 4.86%)

Note: Prices & Yields are approximate as of June 5, 2020 and will be used for comparison purposes at a future date.

Disclaimer: Talk to a professional advisor before investing or do your own research. This website is for discussion and informational purposes only. These are my opinions, do not base you investment decisions on material found on this website.

Brookfield Asset Management

Brookfield Asset Management Royal Bank

Royal Bank Canadian Natural Resources

Canadian Natural Resources Methanex

Methanex

I saw that unemployment graph too, it’s crazy. Literally off the charts.

Keeping cash on the sidelines as well.

I got some TD Bank too recently. Loblaws has a huge market share of groceries in Canada (over 30%). I’m a big Loblaws shopper. One thing I noticed was that I was impressed with G. Weston’s response to COVID-19, his emails were very good compared to the rest!

My feeling is people have to be buying a lot more groceries these days and I think the numbers will show that next Q report. Hopefully the added expenses don’t negate that.

Galen does seem very down to earth and in touch with normal people for someone so wealthy. It’s refreshing to see. A friend/colleague actually got to work with him in a PC TV spot a few years back.

I totally agree with you that the current market is risky. In my opinion, I think it’s important to separate the emotions from investing. With the spread of the virus, it is very concerning, no doubt. How the market reacts to news, I can’t control. However, I can control how and when I invest, so I tend to focus on that.

It’s so true. IMO market reactions (or sometimes overreactions) can be a blessing in disguise, giving opportunities to purchase companies who’s share prices get detached from their economic reality.