Monthly Money Goals – July 2020

So I’ve decided to do some monthly financial and personal updates for readers who would like to follow along.

A quick back story. I’ve always been a saver and have been completely cognizant of where my money goes – in fact I was getting close to having my mortgage paid off on a single income and average salary in my early 30’s. Well, those plans were put on hold and somewhat aborted for a period of time. Life sometimes gets in the way of your ambitious savings goals. Things like family and kids take priority, other surprises pop up. Not to say continually saving isn’t important, but it’s also not always feasible and everyone needs to find their own personal balance in life.

Time to get back on Track

I’m not going to be doing any net worth tracking + dividend income tracking. It’s not something I want to put out there personally. I do however, enjoy reading other financial bloggers updates on this topic 100%. But at the same time, I think the numbers can be skewed if they aren’t presented together.

For instance, someone may not have a lot of dividend income, but might have growth stocks that appreciate rapidly resulting in their net worth increasing substantially. If we don’t pair these two stats, it’s hard to get a full financial picture. I think that the appeal of “dividend income” can also sometimes make people lose sight of their overall goals. Capital appreciation, increased net worth and ultimately financial independence and/or retirement.

So my updates will be strictly tracking savings for now, as I thought it might be fun to record and review. I also believe that writing down your goals is a great way to hold yourself accountable, or at least remind yourself of what you set out to accomplish during a specific time period. While the net worth tracking is off the table publicly, I will track my monthly dividend income for fun and may release that via my email newsletter if people are interested to see which stocks I hold. I’m not sure it will be of any help to the hardcore dividend investors but may at least provide some stock ideas to research. My goal at the moment is not the continually growing dividend income, so it’s more just an interesting thing to track and if the income grows, great!

How will I Track my Goals?

This may just be a case of trial by f.i.r.e (see what I did there?) and see how things go. I’ll track organically for now and edit and improve on the fly. I’d like to include some Financial Goals for the year, some Business Goals and some Personal Goals.

Financial Goals

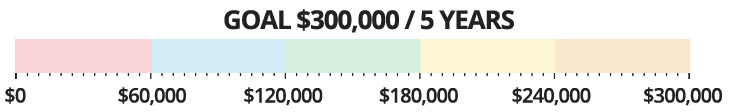

My ultimate goal at the moment is to save $300,000 in the next 5 years. Yes, you read that correctly. Aim high, right?

(When I re-read that sentence I thought it said, “am I high?”)

So yeah, it’s slightly ambitious for a family with kids, a mortgage and normal salaries – but that’s what makes it a challenge. Plus, if successful it will prove that anyone can achieve financial freedom through lifestyle choices and hard work. How I plan to allocate or invest the savings will depend on a number of factors along the way. Essentially I’ll be trying to maximize savings value as well as de-risk to a degree by diversifying, leveraging methods such as:

- Mortgage Repayment

- RRSP Contributions

- Tax-Free Savings Account investments

- RESP Contributions

- High Interest Savings Accounts

Want to Follow my Money Saving Journey?

Subscribe for monthly updates on my savings progress and the latest articles.

Business Goals

I realize this will take time and effort, it’s not exactly a new venture for me. I started blogging in 1998 and still have a few other websites kicking around. Some properties are extinct, but at times had seen viral content pushing up to 1 Million page views in a day. What I’m saying is, I know how difficult it can be for a new website to build traffic. You can help me though! Just follow my story and share the website or an article you like with some money-minded friends who might enjoy it.

Personal Goals

At the beginning of June I posted the 30-Day Money Saving Challenge – well it’s time to axe some non-essential expenses and use up some of those gift cards to kick start the savings. I had some large expenses to take care of the past couple months, but now that those are mostly out of the way, it’s time to see if I can kick the savings into high gear. How do I plan to do this?

LOWER EXPENSES

Our expenses have decreased because of COVID-19. We plan to save on child care this year, save on fuel due to less commuting, activity fees from things like kids camps that have been cancelled and adult recreational activities and sports since many facilities remain closed.

HIGHER INCOME

Earn additional income where possible. I’m not going to count dividend income toward this category or in any of my savings numbers. The additional income will be things like overtime pay, side-hustle money, income from websites or product sales online.

OTHER

This is kind of a miscellaneous category, including savings through rebate sites like eBates/Rakuten, freebie deals, credit card rewards, cash back and selling items from de-cluttering efforts.

I’ll try to give some more specific detail in my monthly updates in terms of a breakdown of how much I was able to save and how. As I mentioned the format will probably be a little random at first and evolve organically.

I’m not exactly sure how I’ll get this all done to achieve the ultimate savings goal. The numbers are possible but also difficult. So I’ll hopefully see you back in August for an update!?

Key Takeaways

When it comes to money, it’s personal and everyone can’t be excessively wealthy, nor do you need to be in order to be happy. It’s not the numbers or the level you’re at, it’s focusing on your own goal and improving your finances.

Let’s say you have $1,000 in credit card debt and a net worth of zero. Yes, $50,000 a year in dividend income and early retirement might seem like a pipe dream, but you have to start somewhere. Creating even a modest savings plan and getting rid of that high-interest debt makes you better off than you were before. Continue saving small amounts for an emergency fund and you’re another step up the ladder – closer to having money to invest and earn that dividend income. At this point you may not be retired and living off your investments, but would you rather be the person $1,000 in debt, or the person with no debt, an emergency fund and a small investment account? Small gains = BIG wins.

Breaking down your goals and having the discipline to follow your plan will result in consistent progress and better finances. This is why comparison to others is not always helpful. While it can definitely be motivating, the focus should be on what you can control to improve your own financial situation. Try coming up with your own personal savings goal that suits your lifestyle.

I can’t believe you started blogging in 1998, lol!!! What, were you 12 or something?

I remember doing HTML in high school haha but it was no where near a blog.

Great goals, I’m trying to achieve something like that too. Ran the numbers, I don’t think it will happen in 4 years but maybe in 5-6 years.

Yeah, I wish. that’s why I need to save so quickly. haha.

It’s hard to tell what nasty expenses might come up, but you never know, hopefully you’ll hit your goal! I’m not convinced I’ll hit mine either, but it gives a nice lofty target and if I fall short there will probably still be a good chunk of change there.