Somehow (possibly inadvertently) I managed to sign up for credit report updates from TransUnions. The updates are sent through my online bank account that alert me of any changes to my credit file. Most of the time when one of these emails lands in my inbox, it tends to be a hard check on the old credit file and sometimes results in a drop in credit score.

No wonder those email alerts get me nervous. Most have been minor blips, or sometimes even nothing at all, but the latest one I opened gave me a bit of a shock and signaled that my credit score had suddenly taken a real dive!

Unlucky 13, or Too Much Credit?

So a little bit of background info. This journey started out with some cashback credit cards from Tangerine that had sort of lost their luster, I had been using these for quite some time, but decided to replace them due to devaluation of the cash back rates. After doing further research and talking to family members, I decided I could get better value from other products and ended up applying for some new credit cards.

I was hopeful that I’d soon be reaping the benefits of these new credit cards, via better point collection rates, travel credits and lucrative sign up bonuses to name a few. At the same time, I wanted to track my credit score to make sure that signing up for new credit accounts didn’t impact it too badly.

To give a quick summary of the article linked in the paragraph above, I wanted to test out how applying for a multitude of credit cards would potentially impact my credit score. Like a credit card guinea pig you could say. My plan was to rack up as many travel points as possible over a short period of time, hopefully without wrecking my credit score.

I went ahead with it, as I wasn’t overly worried about my credit score since I didn’t have any important loans to apply for or any other big credit needs I could think of. So with a score in the 865 range, and not having any new credit cards acquired in a few years – I started applying for a bunch of cards from various issuers, doing my best to avoid any denials while trying to maximize the rewards. Why would I do this, well you can read up more on travel hacking if you’re curious – and as I’m sure you know, air travel and hotels for families can get expensive!

APPLYING FOR CARDS

Based on all my research on Credit Scores, things went pretty smoothly and as expected. My score would have some very minor fluctuations but didn’t just start rapidly plummeting more and more with each and every application, as potential new credit card churners sometimes fear. That unnecessary fear actually tends to be a deterrent for a lot of people from ever even applying for new cards and taking advantage of some of the lucrative rewards.

Generally the applications went pretty well, or so I thought. Funny enough, after starting to formulate a previous iteration of this article and confirming my credit score was largely unaffected by applying for new cards, I decided to apply for two or three more. That’s where things went downhill.

EVEN MORE CARDS

I had been doing a lot of shopping at Real Canadian Superstore using their PC Express grocery pickup and couldn’t resist the PC Financial MasterCard that was offering a 100,000 Optimum Points sign up bonus. For those unfamiliar, it’s equivalent to $100 in groceries at any Loblaws or Shoppers Drug Mart stores. The deal was way too tempting.

I also applied for and was approved for a BMO World Elite Card offering a great limited time 10% cashback bonus – this card required a higher income level and also offered more total available credit. Finally I applied for a Scotiabank cashback card and to my shock and disbelief –was DENIED! Yikes.

MY FIRST REJECTION

This was the first credit card I had ever been declined for in my life. Before applying I had looked over all of the terms to ensure I was eligible, which I was. It was also somewhat odd considering out of all of the major banks I had applied through, Scotiabank is the only one I really even deal with and already have account with and great payment history. That includes a number of mortgages over 10+ years with perfect repayment records! I called the bank’s credit card line and they implied my total financial commitments versus my income were too high. I disagreed with their assessment completely, but there wasn’t much I could do. My guess was they have tightened their lending policies since it was in the middle of COVID-19 and were being extra cautious. They did express that the card denial shouldn’t affect my credit score.

So was it the fact I was denied a card, or the issue that I now had even more total credit on file? Those two additional cards brought my total to 13 cards and added another $20,000 in available credit to an already beefy pool of available credit. So whatever event was responsible, it led to that lovely pop up alert. I had received the dreaded credit alert email, and suddenly my credit score had dropped!

Was I wrong!? Had I just dished out some bad advice?

Tracking my Own Credit Score / Drop and Recovery

Based on your income, you should have a general upper limit on how much institutions will allow you to borrow in total. With a mortgage, lines of credit available (not utilized) and 13 credit cards – maybe I had reached that limit. Consider too as I mentioned, I also had a number of large bills on a couple of the credit cards and charge card accounts coming due that month. They were not overdue by any means, but they were sitting there as large unpaid monthly balances.

As a result, my total credit utilization (although temporary) was definitely higher than usual. My hope was that once I paid these bills and lowered the total amount of credit being utilized, that my score would gradually go back up to where it had been before.

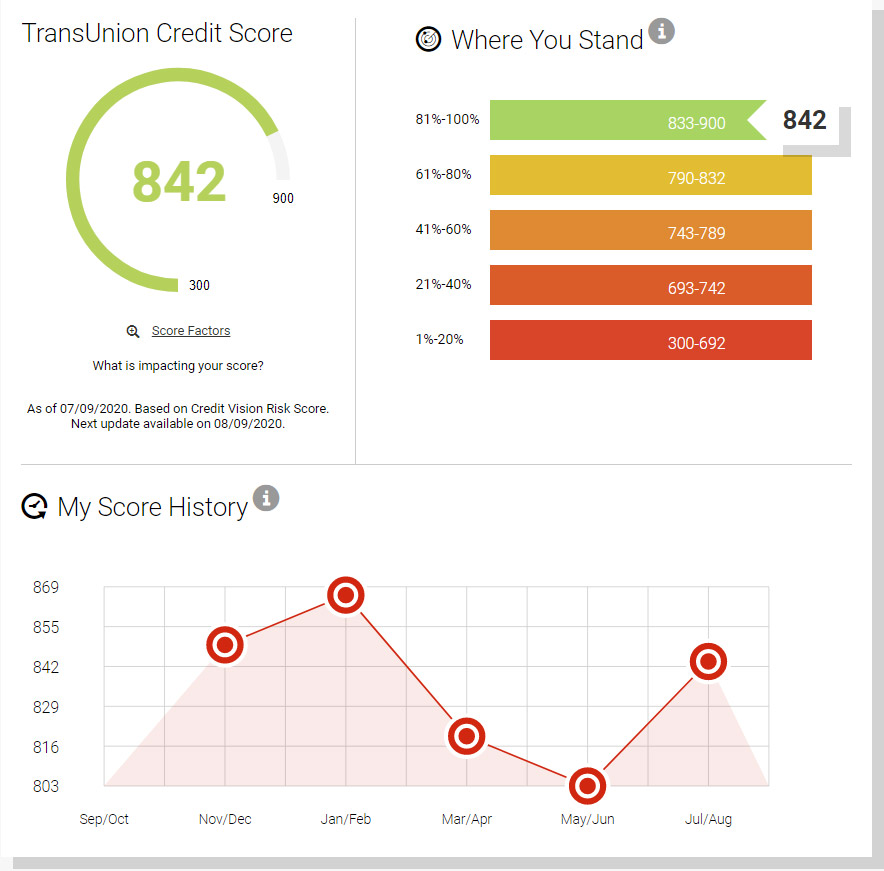

In total my credit score ended up dropping just over 60 points, seemingly just from applying for a couple new credit cards! Now I know that’s not a “huge” decrease, as your score can drop even more dramatically from things like overdue payments or accounts going to collections, but it was still a decent sized hit. My score ended up decreasing from about 865 to around 803.

Credit Recovery, but not Completely

I didn’t freak out too much over this, I have some money/finance friends that seem to have the single solitary goal in their life of achieving and maintaining a perfect credit score of 900. Me, I don’t really care that much – top quintile or whatever will get me the best rates is fine with me.

While it sucked being dropped into the second-tier, yellow band of 790 – 832 on TransUnion, I figured I’d pay off those large bills and just start using the new cards I had received and paying them off regularly. Generally if you have a lot of credit available and demonstrate that you can manage it responsibly through timely repayment, your score should gradually improve and further increase over the months and years.

It took about two months, but after a few payments on each new card and reducing my larger credit card balances to more normal utilization levels, my credit score improved. It jumped back up from around 803 to 842, an increase of 39 points. Why such random numbers? I don’t know. Now it’s not where it was at it’s best, I think the highest my score has been since I actually began tracking was around 880. Regardless, the point is that your credit will recover as you continually make all your regular scheduled payments.

One of the main reasons I like to point this out and show the actual numbers as proof, is that many people are scared to apply for a new credit card and worry about a big drop in their credit score. If you act responsibly overall with your money and are applying for the right cards, you shouldn’t really have an issue and can actually get some great deals in terms of sign up bonuses and credit card features. If I can carry 13 cards and keep a score in the mid 800’s without a problem, then it just proves there really isn’t that much to be fearful of and you won’t completely destroy your credit.

More Tracking to Come

At this point I don’t plan on getting any new credit cards. The only one that has caught my eye is the Canadian Tire Triangle card, as they offer great cashback at Canadian Tire and include roadside assistance as a bonus. I have CAA right now still and haven’t been shopping at Canadian Tire as often with the pandemic happening, so I’m holding off at the moment but will consider it at some point in the future.

I also want to continue tracking the status of my credit score “as is” without adding any more accounts to confuse things. This way I can then see if my score improves further from simply managing the existing credit I have. I may product-switch some cards to move away from collecting travel points, it seems like a valid excuse to change or get rid of some travel cards during a flight restricted pandemic era and shouldn’t affect my score either.

As for the current credit score, I fully expect it should improve through normal use and frequent on-time payments. I guess only time will tell, but I’ll be sure to update the status in a few months and possibly later on if I decide to apply for any new cards.

Was it Worth the Credit Hit?

I would say with all of the Sign Up Bonuses and Rewards that are available, it was most definitely worth the small credit hits taken from applying for multiple new credit cards. The rewards definitely outweighed the risks for me and I can say that with certainty after tracking and seeing the results.

At this point my credit score has only dipped (and likely temporarily) around 25 points. The value of rewards however, for this year for our household has probably exceeded $10,000. Yes, really that much! I have spreadsheets around to track all the rewards and I promise I will tally it all up at some point.

In total, between flight rewards, points, statement credits and cashback, it has 100% been worth the effort in my mind. Worth the energy to find the best credit cards available and then apply for and use them at the right times and places. You can also pull more value if you can get your family or friends onboard and using the cards properly to optimize rewards, and more.

Exercise Caution when Taking on Credit

You can absolutely get some incredibly valuable rewards with your credit cards, but there is one point of caution I would note to anyone who decides to apply for new cards. Be careful if you have any near-term plans to apply for other important credit. For example, if you need a mortgage or have a mortgage renewal coming up, don’t risk damaging your credit score temporarily. The problem is that you may not get the best rate on a larger and more important loan. That in turn could cost you a lot of money in the long run, by having to make higher interest payments over a long period of time.

This advice would hold true for other loans as well, such as a line of credit for home renovations or a vehicle loan. You want to have your credit score at its best, to ensure you get the best rate and terms available when you apply. You’re much better off walking in with a score of 820 than 750 and have a better chance of walking out with the best loan possible.

So use your best judgement in regards to timing and card applications. If you don’t feel like you can manage multiple cards or accounts responsibly or make payments on time – don’t do it! You’ll just cost yourself money and give yourself headaches. It takes discipline as well as good organizational skills to manage multiple cards. Yes, anyone can do it if they put their mind to it, but ensure you have the time and commitment to follow through.

I decided to take the plunge and so far it’s gone well minus some small dips in my score. I’ll do my best to provide an update later on and hopefully have my score back up nigher in a few months time.

Haha been there done that!

I had a credit card denied too and my ego was bruised for a few minutes. It was the same reason as yours, just had to pay a card off and then applied again and BOOM, got approved those b*stards they can’t say no to me!

Anyway, I would highly recommend the Triangle World Elite. The Road Side Assistance is amazing- I have used it three times so far. Also you can pay off your utility bills and property taxes with that card and collect CT Money, and get that pressure washer you’ve been eyeing.

I may have to try that in a few months. Scotiabank has been hounding me for 3 years to get a card with them and when I finally apply, they’re like, “NO CARD FOR YOU!!!”

My car is falling apart, so Triangle sounds like the way to go. I didn’t know you could pay utility bills and property tax with it??? This card is a no-brainer if it’s true. Thanks!