The Canadian softwood lumber players have hiked their way through some exceptionally dense brush over the past year and a half. The combination of sawmill closures and curtailments have been the ongoing storyline due to a number of factors, many out of the industry’s control. Factors including biological pests such as the Mountain Pine Beetle along with political pests, resulting in tariffs and increased costs from U.S / Canada Trade wars. Not to mention political issues at home with high stumpage fees in British Columbia among other issues.

The Canadian softwood lumber players have hiked their way through some exceptionally dense brush over the past year and a half. The combination of sawmill closures and curtailments have been the ongoing storyline due to a number of factors, many out of the industry’s control. Factors including biological pests such as the Mountain Pine Beetle along with political pests, resulting in tariffs and increased costs from U.S / Canada Trade wars. Not to mention political issues at home with high stumpage fees in British Columbia among other issues.

The resulting environment meant low, low prices… to the point that producers could not make any money selling finished lumber from the raw logs. A historically cyclical industry, leading up to the low prices and issues faced by the Canadian (and more specifically Western Canadian) producers, had been record prices in 2018 where lumber was trading in the $600+ range per MBF (thousand board feet).

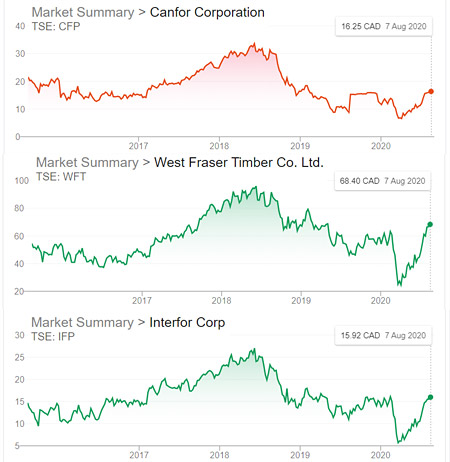

Then, the summer and early fall of 2018 saw prices collapse from those all-time highs. The result was pricing cut in half to around the $300 dollar per MBF mark. As such, the majority of Canadian producer’s stocks followed suit with this trend. Share prices dropped 50% or more in most cases. The majority of investors did not want to touch the stocks at this level and with so much uncertainty in the industry.

Normally this would appear to be a great return on investment, but perhaps not so much when considering the stock was trading up to $32 only a year earlier, leaving many with a large potential loss – even with the buyout premium attached. So not overly surprisingly, the shareholders voted against the private takeover of Canfor, underlining the fact there was likely still very good value in the sector as a whole and in Canfor’s operations specifically.

After all that transpired, COVID-19, unfortunately, added a lot of uncertainty into the mix and in March of 2020, the prices of lumber and the associated Canadian producers stocks dropped once again and even further, albeit temporarily. But as all good long-term thinkers and investors focus on the fundamentals of the long game, it now appears that Pattison would have made out pretty well on his bet if the transaction had been completed.

The Highs & Lows of the Commodity Cycle

The forestry sector sees prices move up and down and at times drastically, like any other commodity. Specifically in this case after the rush to harvest logs due to the Pine Beetle infestation. As previously mentioned the subsequent price drops from oversupply and high costs led to many mills being temporarily or even permanently shut down. Prices never really recovered and then with COVID-19, prices declined even further. With declining interest rates, low production and on top of it all, a 7-month strike by Western Forest Products union workers, a perfect storm seemed to be brewing for a bull case on lumber stocks.

After a month or two of lockdown, it appeared that many worst-case scenario fears were easing. Housing starts were still close to an all-time high in the U.S. People being locked in their homes with nothing to do had actually decided to repair and renovate their homes. Building projects such as decks and gazebos that had previously been put on hold, were now suddenly a way to pass the time at home and remain productive. This is turn made lumberyards and the Home Depot’s of the world struggle to secure enough inventory.

Once lockdowns started easing, there was also a pent-up demand in the housing market and prices have actually seen a YoY increase in many areas, including new builds. This in combination with a lack of lumber supply due to the previously mentioned shutdowns and curtailments and just general lack of logging activity due to COVID has created the perfect recipe for record-high prices.

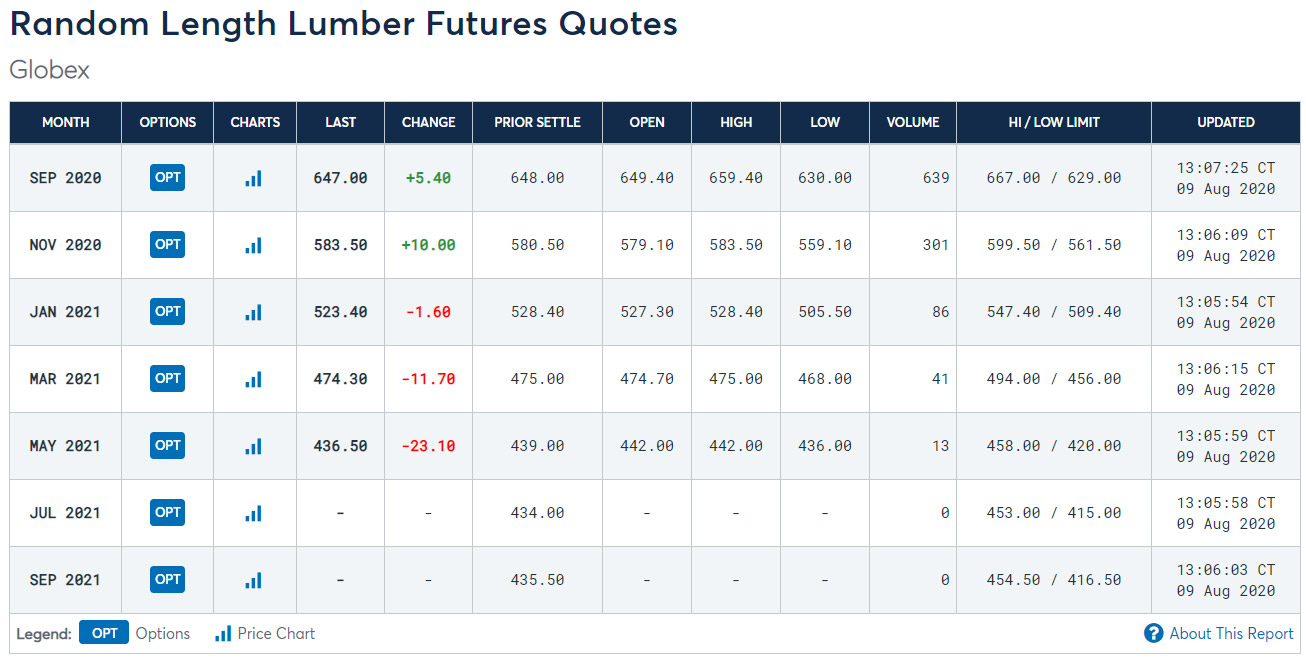

Lumber futures prices have more than doubled since April, going from the $260 range to almost $650 most recently as of writing this. The expectation is that they may climb even higher. There is a big shortage of lumber right now for both home builders and big box stores including some sky-high prices for things like pressure-treated lumber and OSB / sheathing. Many such as builders are bidding whatever they need to in order to secure the lumber they require for existing projects.

If we go back to the story of Canfor and Jim Pattison, the stock which now sits just above the $16 mark, was trading at over $30/share the last time lumber prices were at these levels.

Most impressive is that futures contracts out until May 2021 are still very high, making it likely that these producers will be lining their pockets with excessive amounts of cash during the 3rd quarter of this year and possibly for quite a while afterwards.

(Please note for disclosure purposes, that while I am using Canfor as an example, I nor my family hold any shares or interest in Canfor)

As you can see above, that although futures prices aren’t nearly as high as the current prices, it could be concluded that the Canadian producers should be highly profitable for at least the next six months, possibly longer at anywhere north of the $400 range. The word right now is that it is still very difficult to secure logs and lumber, so if demand stays at the current levels, it will take a while for the mills to catch up.

With all that said and the backdrop of COVID and an uncertain economy, there is still potential for a reversal or investors cashing out. While people still seem to be spending right now, who knows what will happen if people begin to lose jobs or homes once federal assistance runs out. The alternative possibility is that we continue on the current path of low supply and production trying to keep up. The result of that scenario could very reasonably be to assume similar stock prices as we saw in 2018 when lumber prices hit the $600+ mark.

It will be most interesting to see how long these pricing levels are sustained, but the longer they are, the higher these stocks will likely go. Other commodities are seeing similar trends at the moment such as Gold, Silver and Copper. People seem to be taking an interest in hard physical assets during a time that growth and tech stocks like Microsoft, Apple, Facebook and the like are consuming a large portion of the Index as a percentage.

Canadian Stocks of all Sizes

For those interested in potentially investing in Canadian Lumber producers, here is a sampling and a brief overview of some of the large, mid-cap and small-cap companies trading on the Toronto Stock Exchange.

Large Cap Producers

CANFOR (CFP.TO)

Canfor is one of the world’s largest producers of sustainable lumber, pulp and paper-based in Vancouver, BC. As an integrated forest products company, Canfor’s segments cover everything from lumber, engineered wood to wood pellets and energy-producing materials. They also have a pulp and paper segment that operates under the Canfor Pulp Products banner. The company is well-diversified and one of the largest producers of products in Canada.

West Fraser Timber (WFT.TO)

West Fraser Timber Co. Ltd. is a diversified wood products company. They produce lumber in various segments such as Spruce-Pine-Fir (SPF), Southern Yellow Pine (SYP), plywood and MDF and veneers or laminated lumber. West Fraser also producers pulp, newsprint, wood chips and is involved in energy. With vast timber resources, the company supplies fibre required for its’ Canadian & US. operations. They are located in Western Canada and the Southern United States.

Interfor (IFP.TO)

Interfor Corporation, another large Canadian producer with subsidiaries in the U.S. Northwest and South, produce for markets globally. Interfor has a wide range of products and specialty products including things like Clear Cedar Finger Joint Bevel Siding, Clear Cedar Solid Bevel Siding, Clear Cedar V-Joint Paneling, Dimension Lumber, Elite, Special Appearance Grade Cedar Timbers and more.

Other Producers to Explore

Norboard (OSB.TO)

Resolute Forest Products (RFP.TO)

Canfor Pulp Products (CFX.TO)

Mid Cap Companies

Western Forest Products (WEF.TO)

Western Forest Products Inc. focuses on softwood forest products, operating in the coastal region of British Columbia. The Company’s primary business includes timber harvesting, reforestation, forest management. Also including sawmilling logs into lumber and wood chips, and lumber remanufacturing. The Company’s log and lumber products are sold throughout the world.

Acadian Timber Corp (ADN.TO)

Acadian Timber Corp. is a Canada-based supplier of primary forest products, but unlike the others mentioned above, in Eastern Canada and the Northeastern United States. Acadian Timber operates and manages approximately 760,000 acres of timberlands in New Brunswick and Maine specifically. Products produced include softwood and hardwood sawlogs, pulpwood and biomass by-products sold to approximately 85 regional customers. The Company has an approximate total of 2.4 million acres of land under management.

Small Cap / Micro Cap Options

Hardwoods Distribution Inc. (HDI.TO)

Hardwoods Distribution Inc. is a Canada-based company engaged in the wholesale distribution of hardwood lumber and related sheet good and specialty products. It operates through its Canada and United States segments. It has a sawmill and kiln drying operation in Clinton, Michigan. The Company supplies its products to the cabinet, moulding, millwork, furniture and specialty wood products industries.

Conifex Timber (CFF.TO)

Conifex Timber Inc’s primary business is based in Mackenzie, British Columbia. They are mainly engaged in the forest and wood products sector and their primary business includes timber harvesting, reforestation, forest management, as well as lumber finishing and distribution. Lumber products are sold in the United States, Chinese, Canadian and Japanese markets. The company also operates a bioenergy segment through its power generation facility also located in Mackenzie, BC, which is complementary to the Company’s harvesting and manufacturing operations.

Other Options Including ETFS & REITS

iShares Global Timber & Forestry ETF (WOOD:NASDAQ)

The iShares Global Timber & Forestry ETF seeks to track the investment results of an index composed of global equities in or related to the timber and forestry industry. This is a way to gain general exposure to the overall industry, and trades under the convenient to remember (WOOD). (Keep in mind this ETF is not Canada specific as are the other companies above)

Weyerhaeuser Co (WY: NYSE)

Weyerhaeuser Company is a timber, land and forest products company. The Company owns or controlled 12.2 million acres of timberlands, primarily in the United States, and manages additional timberlands under long-term licenses in Canada. The Company’s segments include Timberlands; Real Estate, Energy and Natural Resources (Real Estate & ENR), and Wood Products. The Timberlands segment’s offerings include logs, timber and recreational access via leases. The Real Estate & ENR segment includes sales of timberlands; rights to explore for and extract hard minerals, oil and gas production, and coal, and equity interests in its Real Estate Development Ventures. The Wood Products segment includes the manufacturing and distribution of wood products. The Wood Products segment is engaged in softwood lumber, engineered wood products, structural panels, medium density fiberboard and building materials distribution.

Outlook for 2020

The Canadian Forestry sector offers an interesting investment opportunity if lumber prices continue to climb or maintain their current levels. A perfect storm has emerged and taken shape, moulding the current market conditions to potentially huge profitability for the Canadian Producers.

If pricing momentum continues to propel this upward climb in futures, Canadian lumber stocks may very well become further disconnected from their fundamentals value and the previous stock market highs seen under similar market conditions in 2018. As always, please consider that this is not a recommendation to purchase securities and to do your own research, due diligence and discuss with a trusted professional advisor whenever investing in anything.

However, there is an interesting story unfolding here, where once down-and-out companies will (potentially) soon be producing excessive amounts of cash flow and profits from operations. It will be an interesting remainder of the year, following the story of Canadian Lumber Producers.

Note: Stock Quotes / Prices / Charts above are as of August 7th, 2020 at market close via Google.

Disclaimer: Talk to a professional advisor before investing or do your own research. This website is for discussion and informational purposes only. These are my opinions, do not base your investment decisions on material found on this website.