Last week’s news reports stated that over 500,000 Canadians had filed for employment insurance versus just 27,000 in the same week last year. I can only imagine this number will continue to rise as small businesses struggle to stay open and other non-essential operations are forced by the government to shut down.

So what can you do if you or your spouse have been laid off due to the coronavirus related public health emergency we’re facing? You’re probably accustomed to a certain level of income and a certain lifestyle your job afforded you. Many have probably had to re-evaluate that reality. So what to do now?

Flatten the Curve, but Try to Raise the Bar

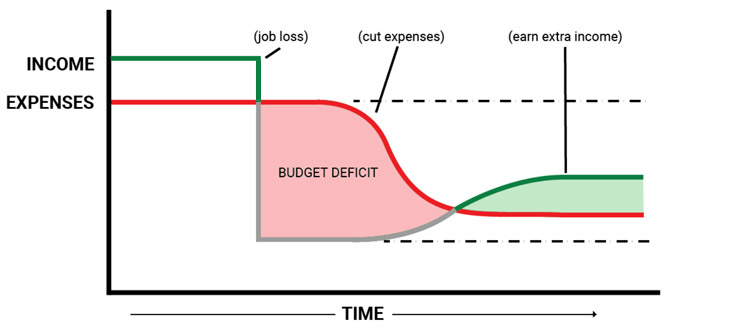

Just like the charts, I’m sure you’ve seen, that illustrate the level our health system can handle, versus the number of sick individuals rising – we can take the same approach with our income vs. expenses. When you lose your job or have reduced hours, your income ultimately will fall and to make up for that you can do one of two things. Cut your expenses, or earn income from other sources. Either way, you will need to get that Income line above your Expenses line to sustain yourself in the long-term. Hopefully, some people can supplement this if you have an emergency fund or savings that can get you through a rough period of time.

Evaluate Your Bills and Expenses

The first option of cutting expenses is probably the easiest and quickest choice for most. If you’ve never paid a lot of attention to your finances before because your income has always exceeded your expenses by a fair margin, it can be a bit of an intimidating task going through a budget. I know a lot of people who are just used to the money rolling in every two weeks, spending it on whatever they need and always having a little leftover. A reduced income can be a major shock to those who live paycheque to paycheque or are simply serial spenders.

First, categorize your expenses the best you can and figure out what your largest expenses are. For most people, this will be things like your mortgage/property taxes, child care and daycare expenses, groceries, transportation and entertainment. (Note – this article focuses on budgeting ideas for our current pandemic and may not apply to normal circumstances)

Mortgages & Property Tax

Your mortgage is a tricky one as you usually can’t just stop paying your mortgage. During this current economic crisis, however, the Government of Canada has urged banks and lenders to work with their customers to provide financial relief options such as deferring payments. Now I’m not exactly sure how this will affect people’s credit – so it is advisable that if you have the ability to continue to pay your mortgage, do so. For those who absolutely cannot, the financial institutions are offering solutions such as deferred payments, usually for up to six months. This does not mean you will pay nothing, but in many cases will only pay the interest and then your missed principal payments will be repaid over a period of time (for example 12 months) and added to your regular payments after the relief period is over. Another option could be a lump sum payment at a later date. The same sort of options are being extended on products such as personal loans, where interest-only payments are required and a new payment schedule or lump sum catch-up payment will be required once you are back to work. These options are all specific to your own situation and you will need to speak with your lender directly to determine if you qualify for any of these alternative payment arrangements.

In terms of property taxes, many people will have this rolled into mortgage payments so it can be taken care of with your lenders’ alternative options. If you pay separately, many municipalities are offering installment deferments of 30-60 days currently. This simply means you have additional time to pay your taxes, but doesn’t necessarily offer any relief from your payment obligations.

BONUS TIP – If your mortgage is coming due in the next little while, the Bank of Canada has already made multiple emergency rates cuts and we are not at the 0.25 overnight target — the lowest the Bank will likely go. If you haven’t looked into renewing your mortgage, you should do so and lock in a lower rate. You will save a ton of money over the long term. If you are in a shorter-term variable rate mortgage, it may be a good time to lock in a low fixed-rate mortgage. Consult with an unbiased financial advisor regarding your own specific situation.

Consolidate Debt

Do you currently have any outstanding loans or credit card debt? Talk to your bank or credit union about consolidating your loans at a lower interest rate. Credit cards are almost always the highest interest rates around, so reducing the interest rates on these payments can help immensely. Lenders are also very willing to work with you and help you come up with a plan to manage and pay off your outstanding debt.

Childcare and Daycare

Daycare is another huge expense for families, in some cases equivalent a second mortgage. The federal government is offering an additional $300 per child in the Canada Child Benefit and provinces are also extending relief payments, for example, Ontario a payment of $200 per child. This is definitely a help, but will not cover the cost for many who pay in excess of $1000-$1500/month for a single child in daycare. It is still unclear when child care centres will be allowed to re-open, but many parents may be reluctant to return their children immediately. There may be a difficult choice for some of simply removing their kids from these programs to save on the costs that they can no longer cover. Hopefully a last-resort option.

Groceries

Food is likely going to be a major potential source of cost savings for people who have recently lost their jobs. Although you wouldn’t think that seeing the recent lineups and food-hoarding that has been happening. While we all need to eat, the amount we spend on our grocery bills can usually be cut drastically for most people, particularly if they’ve never really done a grocery budget before. If you’re in seriously dire straits there are a lot of cheap food options to fiercely slash your grocery bill, and while possibly not the healthiest option or sustainable long-term, can definitely get you by during hard times. Simple ideas like buying less meat, staying away from processed items, ready-made dinners and things like snacks, sugary drinks or other non-essentials can hammer down your budget. Eliminating food waste can also help curb costs. Come up with a basic meal plan that will sustain your nutritional needs and then think of all the items you buy that are really considered a “treat” and consider if you really need it or more importantly, can afford it. I will soon have a more comprehensive article available on slashing your grocery budget.

Transportation

With the current market conditions, this should be an easy area for people to cut expenses. Most people are driving less as they’ve been forced to stay at home. Cheaper oil due to political disputes in the middle east and Russia have also largely contributed to lower gas prices. Other ways to save additional money on your transportation is to simply make fewer trips and plan your outings in order to reduce your driving and save on fuel. If you have the option, the weather is getting nicer out and some days walking to the store could be an option. If you are really desperate for cash, there is always the option to either temporarily park (or even sell) your car, lower your insurance and use public transit for the time-being — although in our current virus environment, public transport may be advisable to avoid.

Entertainment

This is another expense that should be easy for people to cut massively, as many entertainment options have shut-down altogether. Movie theatres are closed, many dine-in restaurants have shut down. Hotels are unoccupied and casinos are vacant. It would take some concerted efforts NOT to be saving money in your entertainment expense categories right now. Increased costs might be things like subscription services like Netflix, to get through the boredom of being confined to your home. But it may also be an opportunity for some to re-evaluate the services you have and which ones you’re actually using or are getting the value out of. Our household does not have cable television, but on the subscription side, we have Netflix, Amazon Prime Video, Disney+ and CraveTV. I might even be missing one, but do we need ALL of these services? Probably not. A second option if you feel you ‘need’ these services, is to share the subscription with a family member or friend, as most of them give the option of “x” number of “screens” per subscription.

Subscription Services

On the topic of subscription services, there are probably other things you can cut or reduce similar to your television bill. Take the opportunity to re-negotiate your cell phone contract or your cable bill. Try to reduce your energy consumption to lower your hydro bills and look at potentially cancelling things you aren’t using like gym memberships.

Instant savings municipalities are providing at the moment are things like off-peak rates, 24 hours a day on your hydro, since so many people are working at home during the pandemic. Some ISP’s are also offering unlimited data and no overage fees, so you don’t have to worry about larger cable Internet bills.

Hopefully, that gives some good ideas on areas where budgets can be cut!

Earning Additional Income

While it can be more difficult than lowering your expenses, it is possible to find additional work and generate alternative income. Here are a few options when you really need those extra few dollars to stay afloat.

Offer your Professional Services Online

If you’ve recently been laid off, many professionals can now find supplementary work online. Accounting services, design services, marketers, fitness coaches, consulting services. So many jobs can now be done online. If possible, try taking your expertise to the Internet and get paid for your expertise. There are lots of sites you can join and offer services.

Blogging, YouTube, Online Sales and Promotion

Many people use their professional expertise or even just a hobby to create content online and earn money through advertising, affiliate marketing, original product sales and more. Now I won’t lead anyone to believe it’s easy by any means, but hard work and consistency can lead to rewards down the road. Choose something you are passionate about.

Delivery Driver / Uber Driver

Meal delivery services are surely booming at the moment, with many restaurants’ seating and dine-in options closed due to the Covid-19 pandemic. Delivering for such services as Uber Eats, Instacart (and I’m sure there are more I’m not familiar with) is an option to hustle some cash on the side. Uber is another option, but probably not advisable at the moment due to the close proximity you’ll be in with others and the current guidelines regarding social and physical distancing.

Dog Walking / Pet Sitting

Dog walking is something almost anyone can do if you love animals, or even pet sitting while people are away or even quarantined! At the moment there may be seniors with pets who still want their pets walked, but don’t necessarily want to venture out into the virus-infested world. Particularly in population-dense urban areas where it can be more difficult to distance yourself from others.

Online Surveys & Research

Many companies offer generic surveys and questionnaires or pay people to participate in focus groups. You will have to evaluate if the trade-off in time is worth the compensation, but there are some professional surveys out there that can be fairly lucrative, although sporadic if you are in a high-level profession. Others can make money as well simply by helping companies with market research and answering basic consumer questions.

Filling the Gap

While you’re stuck at home in quarantine or self-isolation, or just forced to “stay home” as advised (and in some places even mandated) by the government, try to remain productive. Take some time to do your spring cleaning and in the process, see what items you no longer need or can get rid of and potentially sell for profit.

Sell Your Goods Online

See what you want to get rid of around the house or don’t use anymore and list the items on Kijiji or eBay. This could be anything from clothes and shoes, to tools, toys or electronics. Please don’t sell toilet paper or Lysol disinfectant wipes.

Utilize Gift Cards

See if you have any gift cards lying around that can be used to bridge the gap in your finances while off work. Things like Visa Prepaid cards, Amazon gift cards, Wal-Mart (for groceries) and any sort of restaurant or fast food gift cards can help you with your budget and keep you from spending money out of pocket.

Cash in Credit Card Points

Do you have credit card points saved up? Some cards like American Express will let you redeem points for statement credits or for things like Amazon purchases. This option could help reduce some of your budget categories by purchasing general household items or grocery staples with the credits or by simply lowering your credit card bill for the month.

Putting it all Together

Try to use some of the spare time you have if you’re off work or working from home and see where you are spending money and how you are allocating it in your budget. Investigate where you can cut back and if there’s potential to bring in any additional cash if you’re coming up short.

Losing your job can be a rough situation, but you can navigate it successfully by making sacrifices and working hard. There is a light at the end of the tunnel and we will all get through this rough patch. It will be more difficult for some than others, but perhaps being forced to take on such a challenge will leave you better off to manage your finances in the future, particularly when emergencies arise. Best of luck to anyone who is struggling.