Yes, there are definitely bigger problems in the world than a cancelled vacation at this point. Luckily, I had not booked anything just yet – but it brings up some good questions regarding what will happen within the travel industry rewards landscape.

It’s definitely hard when your excitement over collecting points becomes anxiety and disappointment. Left holding the bag, so to speak and wondering if points you worked hard for will be devalued or even worse if certain airlines will go broke. What will hotel chains do after the pandemic has left their balance sheets in the ICU? Questions that nobody really knows the answers to, but are some interesting things to ponder and evaluate. Should you continue collecting points or switch to cash at this point?

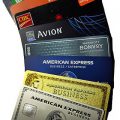

Last year, I began collecting American Express Member Rewards points (best offers available by using referral link) along with Aeroplan Points, RBC Avion Rewards and Marriott Bonvoy points. Utilizing personal and business spending with a careful plan, I’ve been able to amass a good amount of points over a relatively short period of time, way better than I ever could have with my old TD Rewards organic methods.

This is all great, but now I’m questioning to a degree what these points currencies will be worth down the road and what the future holds for the programs. Are the points programs in Jeopardy?

So what are some other options if you’re unsure whether you want to continue collecting travel rewards or are just plain nervous to begin flying again with this unprecedented virus situation we’re currently living through?

What to collect now?

I’m trying to think about what other options are even available to most of us besides Travel and Cashback cards. Maybe someone could enlighten me in the comments with ideas or alternatives they’re aware of. But if you decide you don’t want to accrue travel points, for now, it might be prudent to investigate which cashback cards will give you the most bang for your buck based on your personal spending habits.

There are a few cards out at the moment offering 10% cash back on initial spending and many offering up to 4% ongoing on gas and groceries. Scotiabank is currently offering their Scotia Momentum Visa Infinite card with 10% cash back on the first 3 months up to $2,000 in purchases. Groceries might be a great option for people right now with all the additional purchasing going on. On the other hand, gas has a good rewards rate, but lots of people aren’t buying gas to the same degree they were a month ago, and the spending on gas has gone down considerably with the recent price drops.

Hold your Points or Cash them in?

That brings up the question for those who are financially strapped right now, do you currently have points that could potentially be cashed in or help you get through a rough spot? I know of a few people who have been collecting things like AMEX points for travel and are now considering using the points for statement credits to help pay off their credit card bills or simply to alleviate some of their financial burden in the coming months.

Ways to Earn Extra Points

A good example is people I know who got travel cards recently and had planned to put their airline tickets and hotels on those cards but can no longer travel in the short term. Hopefully, it appears (hopefully) that other providers may be offering some help in getting people to continue to at least attempt to meet these spends, which is good for the banks and may bode well for the economy.

One idea for earning some extra points or cash back and to be helpful at the same time is to go get some groceries for your neighbours. We’ve had neighbours offer to pick up groceries for us, and we have reciprocated. This helps keep traffic in the stores down and minimizes our trips out of the house while the ‘quarantines’ are still in effect.

If you have vulnerable family, friends or senior neighbours or even friends who have been required to self-isolate for 14-days – you can help them out and earn some points at the same time. Pick up groceries for these people and use their purchases to help you hit your minimum spending requirements. Just pay the bill on your card, drop their groceries off on their porch and have them reimburse you with an e-transfer. Better yet, use their spending to get additional ‘cashback’ by utilizing programs like PC Optimum or unlock even more value by joining the PC Insiders Club for even more points on your purchases. You can also help out any seniors in need by picking up items for them at places like Shoppers Drug Mart or the pharmacy as well. What better way to earn points in a tough environment than with other people’s money!?

Credit Card Interest Rates Lowered

One positive development on the credit card front is that Canada’s big six banks have decided to lower credit card interest rates. While it seems like a nice gesture, it’s honestly probably just as well for them to have people continue paying their debts at a lower rate than to default on their loans altogether.

The Bank of Nova Scotia, along with the Bank of Montreal, have announced they are temporarily reducing their credit card interest rates to 10.99% for customers receiving payment deferrals. TD, Royal Bank and CIBC have announced similar programs and offers for consumers.

Some of these offers come with caveats, such as lower interest rates on personal cards with a payment skipped, so don’t hold your breath that these rates will last forever.

At Family Money Saver, I, of course, never recommend anyone carry a balance on their credit cards anyway unless you have absolutely no other choice, perhaps in an emergency. Credit Cards generally carry interest rates in the range of 19.99% – 20.99%, and there are most likely other ways to get cheaper credit offerings or loans.

Conclusions

Personally, I am fairly optimistic about the travel card front and hopeful that we can travel again soon. While many of us wonder if travel points will be de-valued or end up as collateral damage because of the recent economic hit to airlines and hotels – I have the view that the companies may need these programs more than ever and may even have some great new offers in the future.

The fact is, people will be reluctant to travel immediately or stay in hotels; that is a very likely scenario. What better way for the travel and tourism industry to get people back in the sky or into hotel suites than to offer additional perks and amenities. It will also be imperative to retain those loyal customers who have already been using their services or accruing their branded travel points before all of this craziness began.

We will wait and see how this all plays out. Once the dust has settled, I’m actually pretty excited about embarking on new adventures, as I feel a lot of others will be too once the fear and uncertainty pass. Being cooped up indoors and being confined to a small area only enhances our urge to get out and explore the world around us. I’m hopeful that day will arrive sooner than we think.

The travel blogging industry has been hit really hard with the pandemic. I usually do a bit of both collecting. Sorry that you had to do all this hard work with cancelled trips- hopefully they open things up soon safely.

AMEX points you can at least take solace in the fact they’re good for actual $$$ in the form of statement credits or cash towards things like Amazon purchases. The Aeroplan miles I’d be more concerned about, but honestly I think it will all be okay given time. Positive thoughts!