Furthermore, I’d bet that a good chunk of people don’t realize how your score affect’s your ability to borrow, but also the lending rates you’ll pay. I was in the exact same position at one point and had to do some digging to find the information for myself. And to be perfectly honest, I was actually afraid to check my credit score for the risk of damaging it.

Below I have tried to break down some basics about credit scores and the importance of how they affect your overall financial flexibility. Also, where you might fit into the different scoring ranges and where you can check your own credit score. I’ll also debunk some credit score myths, how you can potentially improve your score, and how this helps your ability to borrow and access better interest rates.

What is your Credit Report?

For those who have no knowledge of credit reporting, your credit report is basically a snapshot of your financial history. It’s one of the main methods that creditors such as banks and credit card companies will use to make their lending decisions on whether or not to grant you credit or approve a loan.

Lenders don’t necessarily report to both Credit Bureaus, so your score may be a little different on either bureau report. While the scores might not be identical, they should give you a general sense of your credit-worthiness or more importantly, alert you to any particular problems with your credit report, such as an overdue bill or delinquent account that is affecting your score.

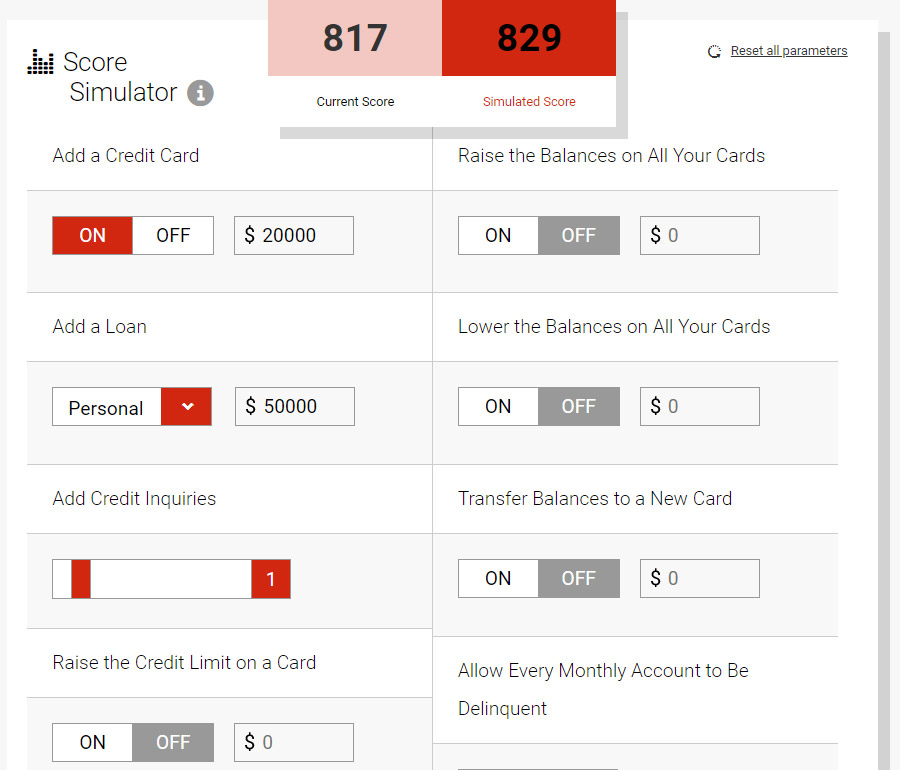

There are also some tools available on Transunion that allow you to simulate your credit score, to check for example what would happen if you were to add a loan, another credit card, close an old account, carry a balance or have a delinquent account. This can be quite useful in helping you improve your score, or when deciding if you want to take out a loan and how it might affect your current score.

Your credit report can be summed up as a snapshot of your financial history representing your reliability as a borrower to a potential lender. It allows them a quick insight into how much of a risk you pose to them as a lender.

So How does your Credit Score work?

You should have a credit score if you have any credit accounts like a credit card, loan or mortgage. Your score is a representation of how you manage those credit obligations. It’s an overall score representative of your borrowing activities in which lenders can evaluate.

The average credit score in Canada is around 650 and varies slightly from province to province. The score is a three-digit number that will be used by lenders to help them determine the amount of credit risk you pose or how likely you are to repay your debts or loans. Lenders will use the score as a factor in determining whether or not to grant you credit. It will also have an impact on how much credit will be extended to you and the rates. The higher your score, the lower a credit risk you are to a lender.

How is my Credit Score Calculated?

Below is a breakdown of how your credit score is calculated using specific categories. Also included are the approximate percentage-weightings of each category explaining how much each category affects your overall score. It can be surprising to find out just how much or how little specific actions can affect your overall credit score.

35% | Payment History / Repayment

The most important factor in your credit score is your payment history. Put simply, do you pay all of your bills on time? Do you repay your loans on time? All of this displays to lenders that you are creditworthy and gives them more confidence to lend you money. Not paying your bills on time, flags you as a credit risk. So if you are doing something like accumulating credit cards for points, you should maintain a perfect score in this category. Not paying off your balances n time would defeat the entire purpose as the interest charges you incur will almost certainly outweigh any points or cashback benefits.

30% | How Much you Owe / Credit Utilization

This one is a little bit more complex in the way it’s calculated by the credit bureaus but is still fairly easy to understand from a consumer standpoint. Your credit utilization is the amount of your overall available credit that you have currently used. Clearly, if you suddenly applied for 7 new credit cards and maxed out the balances on each immediately, this would look extremely concerning to a new credit issuer when reviewing your credit history. However if you averaged $1,000 – $1,500 on each card and paid them off every month, not such a big deal. If you over-leverage yourself, you become more of a risk-based on your ability to repay what you have borrowed.

15% | Age of Accounts

The age of accounts portion of your credit score represents how long you have had certain accounts open for and in good standing. If you’ve had a couple of credit cards for 12 years, this is a good sign that your accounts are and have remained in good standing. However, if you are young and have a limited credit history, you will be riskier to a lender as they lack information since there is not much of a track record of your credit history to go off of.

10% | Credit Mix

Your credit mix gives a snapshot of the types of credit products you have been approved for or have utilized in the past. Think of this as the diversity and experience of your credit history. If you had the choice, would you rather loan money to Person A with a history of paying off a mortgage, all household bills, three credit cards and a car loan? Or Person B who is paying one credit card and a small student loan. While it’s not a huge portion of the rating, it does give a sense of your debt servicing habits and contributes to a lender’s willingness to extend credit to you.

10% | Credit Inquiries

The final part of your score involves the number of credit inquiries you have and the recency. When your credit file is accessed by lenders for whatever reason, it is recorded with the credit bureau and logged as an inquiry. This is not necessarily bad but may affect your credit score to a small degree in some instances. Cases that may affect your credit score are called “hard inquiries” or “hard hits” and are generally when you are actively applying for new credit. These can hurt your credit score, as they can indicate potential financial instability, for example, someone who is suddenly seeking lots of new credit. This isn’t always the case though, as applying for a new credit card doesn’t automatically mean you are suddenly doing poorly financially. It can however suggest this when combined with other negative factors in your credit score.

What is a good score?

As mentioned, your score is a three-digit number that lenders will use to assist them in deciding if or how much credit to make available. Clearly the higher the score, the better – but what is a typical scoring range? A higher score equals lower risk associated with the borrower. Scores are calculated using numerical weighting according to the criteria above and a formula is used to construct your individual score.

Typically you will be doing well to maintain a credit score in the 700+ range. This will make it easier for you to borrow money and possibly at better rates. The average score in Canada is roughly in the 650 range but varies slightly from province to province. You should remember that your credit score is not the final deciding factor in a lender’s decision, as each will have their own unique criteria to assess credit risk associated with a particular individual.

Understanding the Credit Score Ranges in Canada

The range of credit scores you can have in Canada are between 300 and 900. Here’s a brief rundown of some approximate score ranges and typically what they would suggest about a potential borrower:

Excellent 833-900 | (81%-100%)

In this range, you really are a lender’s dream. You can likely count on many instant approvals along with the best rates to be offered.

Very Good 790-832 | (61% – 80%)

Your credit score is very good, but not quite in the upper echelon just yet. A strong and continually growing history of timely payments will reward you in the long term with an even better score and borrowing rates.

Good 743-789 | (41%-60%)

You will likely get approved for credit and receive reasonable interest rates. Some further work and commitment will help you bump your score up further.

Average 693-742 | (21%-40%)

You may have a tougher time getting approved for certain loans or credit products. You may need to further build, or possibly improve your credit history by making all your payments on time or accumulating more credit experience. This can be done through loans or credit cards, demonstrating you can manage your payments on time.

Poor 300-692 | (1%-20%)

A credit score in this range is going to limit your ability to borrow and will also affect the interest rates offered to you. Generally, these will be high rates as you will be considered a high-risk borrower. Many may simply refuse to extend you credit, period.

The percentages above are a representation of TransUnion’s Risk Scoring and represent the approximate percentage of people who have a worse credit score than you. As an example, having an Excellent Score Range of 833-900 would mean that your score is higher than 81%-100% of the other consumers in Canada with a TransUnion file.

What are some Credit Score Myths?

Below are some myths debunked regarding your credit score and some ideas of what can actually have an effect on it.

1 | Checking your Credit Score will Negatively Impact It.

This is false. Checking your own score will not adversely impact it. Third-parties that do a credit check on you may do a “hard pull” or a “soft pull”. A hard pull will potentially have an effect on your credit score (see the link above for more information). Checking your own score, however, will not negatively affect it.

2 | Closing a Credit Card will Improve your Score

This is also false. It follows a logical thought process that reducing the amount of credit you have available would raise your score. The truth is that it can actually have a negative impact, but why? Remember that “age of accounts” also matters – so closing an old credit card that you have a long history of timely repayment with, could potentially impact you negatively. Many people advise holding onto your oldest card. Keeping such cards could be of benefit to your score assuming you continue to use them responsibly. Another point to keep in mind is that closing a card you’ve had trouble with, won’t necessarily help your score either. Negative accounts will stay on your credit report for 6 years from the delinquent date.

3 | Paying the Minimum Balance Maintains your Score

Not true. While you are in fact making all your minimum payments if anything you’ll likely be carrying a higher balance that you can’t afford to pay off. Carrying a balance and accumulating further charges on your card each month, you’ll most likely be increasing your overall credit utilization ratio – what you have borrowed versus credit you have available.

4 | Higher Income = Higher Credit Score

Again, not the case. Earning more does usually increase your ability to pay off debts, but it also allows you the opportunity to borrow more. The same factors above are relative whether you have $10,000 available and utilize $2,000 of your credit, or $50,000 available and utilize $45,000. Which scenario appears riskier?

5 | Co-Signing does not Affect your Credit Score

False. If you co-sign a loan, you are also responsible for the repayment of that loan. If the amounts owed are not paid or are overdue, your credit may be affected just the same as the primary borrower.

How can I get my Credit Score?

Borrowell (Get your Equifax score)

Credit Karma (Get your TransUnion score)

Conclusions

Your credit score is a good representation of your credit history and overall risk at a glance to lenders. It is however not the be-all, end-all determining factor on whether or not you will be extended credit or what rates you will be offered.

Other key points to remember are that you are in control of the majority of your credit score. Having the knowledge of what factors make up your score and the weightings of each, will help you ensure you are doing the right thing. Things that will best help increase your score and maintain it in the future.

You should really be aiming for a credit score of 700+ and work to actively maintain and increase it. The largest determining factors by far, are well within your control. Pay your bills on time and don’t over-leverage yourself. With these rules to live by in mind, you should do well and your score will increase over time.

Note: The above Credit Score Ranges may not be exact and vary slightly depending on the score provider, but in general this provides a reasonable guideline in terms of assessing your own credit rating in comparison to the general population in Canada.

I could not refrain from commenting. Perfectly written! Do you have a newsletter or somewhere I can subscribe to new posts?

Kindly let me know so that I may subscribe. Keep up the great work.

Hi Bill, you can subscribe to notifications in the lower right hand corner by clicking the Bell icon. 🙂 A newsletter is in the works with weekly updates, but not ready quite yet. Thanks for your interest.

Howdy! I simply wish to give you a huge thumbs up for the great info you have right here on this post. I’ll be returning to your web site for more soon.