One of the better credit cards for self-defence just arrived at my door. The American Express Personal Platinum card made unmistakably of metal and your best choice to fend off an unexpected attacker.

Kidding aside, I was pretty excited to review this card but put a halt to it after about a week. Unfortunately, those familiar with American Express and their generous bonus offers and referral rewards were abruptly slapped in the face in recent weeks after briefly beaming with joy.

Let me explain…

AMEX BONUS OFFERS

American Express has typically offered some of the best welcome offers and bonuses in Canada on its credit cards and charge cards. The most recent offer for the American Express Personal Platinum was hailed as the new best credit card in Canada. In short, you could turn this card into essentially a 4% cash back card on EVERYTHING.

A) A 60,000 MR point welcome bonus offer when you reach the minimum spend of $5000 within 3 months (updated to 6 months now due to COVID-19)

B) Another 10,000 MR points after 6 months of card membership

C) Double Rewards on all of your spending categories.

D) Double Redemption Value of your points!!!

So what’s the catch, besides the requirement of having to spend $5,000 in 3 months?

Well, the biggest one would be the annual fee, at a whopping $699! I mean really, who would pay $700 just for the privilege of having a fancy looking credit card? Someone really bad with their money right? Not someone reading a money-saving website.

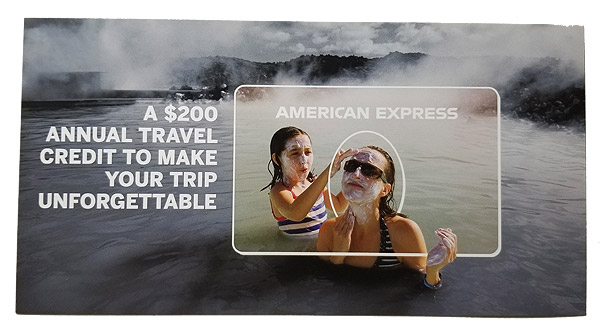

But hold on for a moment, the card has some great benefits in return for the fee, which I’ll outline below. There’s also the fact you get a $200 travel credit, which may not be as valuable at the moment, but still has monetary value and can be applied to flights and hotels.

Still not excited? Well here’s where the real perks kick in. Before even signing up, you could potentially get a friend or family member 15,000 MR points just for referring you to the card! Maybe they’ll be nice and split the referral bonus with you. And here are the benefits for you…

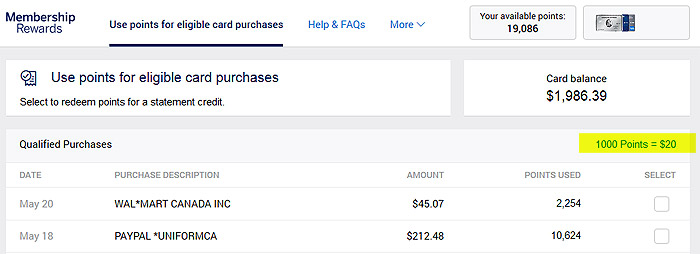

Amex Member Rewards (MR) points can be redeemed for statement credits, which is as good as cash if you are actually buying things! So those 60,000 welcome bonus MR points are totally worth the annual fee. Also, don’t forget in order to earn the bonus, you would have spent at least $5,000 (so add another minimum of 10,000 MR points to your total — since the double rewards promotion was on). And of course the “double-redemption”. As you can see below, those 10,000 points would be worth $200 applied to your statement!

So just with the bonus, you’re now sitting on 70,000 points normally worth a $700 statement credit — but oh yeah, we have the “double redemption” offer as well! Turning your $700 credit into a $1400 statement credit. Do note though, that the double-redemption promotion ends on July 20th, 2020 – so redeem your points by then if you plan to!

With the bonus and spending alone you are now netting $1400 in credits – $699 in fees = $701 + your $200 travel credit equaling a $901 value plus all the card benefits! …Did I mention its metal?

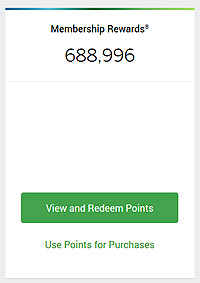

On top of all this, if you were already an Amex Business Platinum, Gold Business or Gold Rewards Cardholder, you could transfer your MR points from an existing account and redeem them for double the value in statement credits. Simply amazing!

BUT, NOT SO FAST…

This is where the fairy tale ends. I’m not sure if Amex just didn’t think this through properly, but they recently as of a couple of weeks ago, started implementing a number of changes affecting their Platinum Cards and Member Rewards points programs.

The welcome bonuses have now been slashed on both the Personal and Business Platinum Cards.

Amex Personal Platinum has gone from 60,000 MR points (on a $5,000 spending requirement) to 25,000 MR points (on a $2,000 spend)

Amex Business Platinum has gone from 75,000 points (on a $7,000 spending requirement) to just 45,000 points (on a $5,000 spend)

Referral bonuses have also been severely devalued on both cards to only 5,000 MR points! Previously they were 15,000 and 25,000 respectively! Amex doesn’t seem to be the only company employing such cost-saving measures with referral bonuses during the pandemic. The popular payment processor “Plastiq” which many use to pay bills they can’t normally pay with Amex, has also gutted their referral bonuses. Previously you’d get 1000 FFD (Fee Free Dollars) equivalent to roughly $28.50 for referring someone. Now you only get 100 FFD (worth about $2.85). The referral who signed up who used to get 500 FFD ($14.25) and after paying $500 worth of bills – now only gets 50 FFD worth about $1.42!!! Not good.

Amex has just recently in the past week or so, also stopped allowing transfers or linking from other MR accounts (other Platinum & Gold Cards), so you can no longer redeem those accumulated points from other cards for the double redemption promotion.

Seems like Amex are wising up and closing all loopholes to save on costs!

I felt pretty lucky with my timing on the card, squeaking in just before this devaluation began. It makes the card much less attractive given the fee, and in short, you are now paying $699 annually for the $25K bonus + 5K in spending = 30,000 MR points, redeemable for $600 in statement credits. Given this is even with double-redemption value, I’d call this a dead deal, which is why I put a hold on my review!

In fairness, it’s still not a bad card, particularly for travellers but sadly many of those benefits have lost their lustre with the advent of COVID-19 – at least for the time being.

For those who are still interested in travelling soon, and getting a premium travel card – here’s a bit of a rundown of the card and some features offered.

Others Notes

CARD PRESENTATION

Want to feel important? Well, that’s one of the things this card is still good at.

As dumb as it sounds, there’s a feeling of luxuriousness and power dropping a card that goes “CLANK!” in the middle of a dinner table full of your friends. The fact that this card weighs just over 3½ times a regular credit card should grab your attention and anyone you hand it to. Little did I know when curious about the weight, there’s actually an article written going over the “heaviest credit cards“.

Your American Express Personal Platinum card will usually arrive by FedEx extremely quickly, I think mine arrive in 2 days after approval. The card comes in a hefty, yet elegant looking box, which opens to reveal all of the accompanying information and feature sheets. Your paperwork is in a fancy embossed sleeve, below it is thick postcards highlighting the card benefits. Below that is the card, seated in the middle on a velvety material, with a small ribbon dangling out the bottom portion of the box giving easy access below. Or possibly to just make it look even more upscale, at least as upscale as a box can look I guess.

Now YES, I know there are way fancier credit card products that come in wooden boxes with felt backing and all that other nonsense. Basically the credit cards for people who are actually rich. Still, the American Express Platinum Card is a pretty cool option for us peasants who want to feel important.

IS IT WORTH $700?

I guess we kind of covered this off already, breaking down the numbers. On the original offer, you could net a cool $901 dollars in value after paying the annual fee. Not to mention the potential for large referral bonuses of 15,000 MR points.

Unfortunately with the scaled-back offers – and travel restrictions on top of things, I’d have to say not so much now. Disappointingly the card rewards will now be pretty close to the price you pay with a 25,000 point bonus + 4,000 points in spend = 29,000 points. Even with double-redemption, you’re looking at about $580 + $200 travel credit, assuming you use it.

Now don’t get me wrong, this card still has some great features, it’s just that a lot of them are not as useful with the current state of the travel industry. I would think in the current economic environment, many people would rather go for a no-fee (or fee waived for 1st year) cashback card at the moment.

For those who are still interested in travel, or have ambitions to travel more in the future, such as myself – here are some of the other perks that come with the Amex Platinum Card.

Others Notes

CARD FEATURES

The Amex Platinum cards offer increased earning rates on things like travel and restaurants. 3x for Dining, 2x for Travel and 1 for Everything Else. If you got in on the initial offer, you can double those rates and double the value again for redemption.

Another great feature of the Platinum Card is that MR points you earn are transferable to other rewards programs and frequent flyer and hotel programs. Popular programs like Aeroplan, Marriott Bonvoy, Hilton Honors and more. You can of course also redeem your points for statement credits when you pay your monthly bill.

CARD BENEFITS

Being a premium Travel Card, the Amex Platinum comes with some nice member benefits including:

- Special Offers and Early Invites to Events

- 2X the points on Travel

- 3X the points on Restaurants

- Access to a $200 Annual Travel Credit

- Access to Airport Lounges / Discounts on Parking & Valet Service

- Access to Special Experiences

- Automatic Upgrades to Hilton Honors Gold Status & Marriott Bonvoy Gold Elite Status

- Free Room Upgrades at Hotels where available

- Platinum Concierge Service

- INSURANCE BENEFITS

- Out of Province/Country Emergency Medical Insurance (For under age 65)

- Trip Cancellation Insurance

- Trip Interruption Insurance

- $500,000 Travel Accident Insurance

- Additional Insurance Benefits

THINGS TO NOTE

This card is packed with all sorts of features, which more than make up for the fee if you are a serious traveller. If you travel for business you can also apply for the Business Platinum Card. Unfortunately right now, of course, it’s more difficult to spend money, particularly in the Travel and Dining categories. So this is a product definitely geared towards frequent flyers and travellers.

Another note is that this is a charge card and not a credit card. The main differences being that your balance must be paid in full each month and you don’t necessarily have a set limit on spending. If you don’t pay your balance by the due date, you will face very high-interest rates and possible cancellation of card membership. Here is a good article that outlines the differences between charge cards and credit cards.

CONCLUSION

The original offer for the American Express Platinum Card was nothing short of spectacular! It’s a shame it had to be reigned in so quickly. But for those who managed to pick up this card recently, the earning rates and redemption value are exceptional and more than warrant the high fee.

Even in missing the latest offer, this is still a solid card with plenty of features and reasonable earning rates. It also now has a lower minimum spend requirement to get your welcome bonus, which may be welcome for many. When all is said and done, the rewards as mentioned are mainly geared towards travel, dining and experiences.

Personally, I would recommend waiting at this point at least until the current double redemption promotion is over on July 20th. It’s also likely people aren’t jumping on planes anytime soon, so it’s not like you’re missing out on potential travel opportunities at the moment. I’d watch for new offers or better welcome bonuses to return later in the summer or early fall. Nobody can predict if this will happen for sure, but with the current offering there are probably better options out there for now and Amex will need something to lure customers back. If you are still interested in this premium travel card, you can apply for it here.