Introduction to Borrowell

You may not have heard of Borrowell before, but I’d wager you’ve heard of Credit Scores. You might even know what your score is or at least have a rough idea. If you don’t know, you’re probably curious what your score is and what exactly the number means.

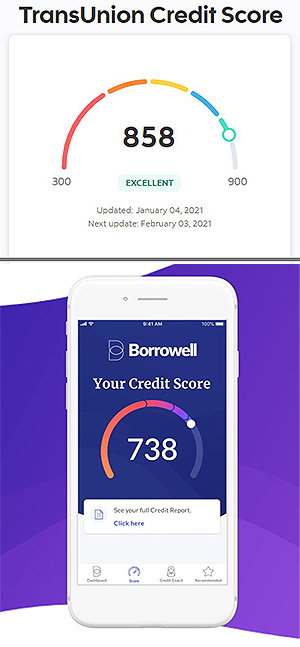

I couldn’t get easy access to my credit score in the past, or at least without paying for it. My financial institution now offers TransUnion credit scores free to customers. However, I still had trouble getting my Equifax score (these are the two credit bureaus in Canada) and didn’t really want to pay the money to see the score and report, since I’m cheap frugal.

Enter Borrowell. Borrowell attempts to demystify Credit Scores for the average Canadian consumer, as they were the first company in Canada to offer free access to your credit score and credit report. With Borrowell, you can get access to your credit score in just 3 minutes!

Not only that, but they’ll send you updates weekly on your credit health and any updates to your score. Curious what your score is? Click the link below to sign up and find out!

Read on for more information on how and why Borrowell’s service might offer some value to you as an individual who’s conscious about credit and finances.

Introduction to Credit Scores

So if you don’t know much about credit scores or credit reporting, that’s cool. While there’s plenty of information available on the subject, it’s not exactly something most people read up on for fun. Usually, your credit report is run when applying to rent a property, get a mortgage, buy a car, or sign up for a new credit card.

So why is it important to have a good credit score? How does knowing how credit scores work help you? Well, briefly, a higher score will generally be a good indication that you are a lower credit risk to lenders. Therefore, allowing them to take on less perceived risk and offer you potentially better loan rates or approval for a wider variety of credit products.

This, in turn, will save you money in interest payments. If you want to get a full overview of how credit scores work, you can read my more detailed article on the subject, “Credit Scores Explained.”

Credit Scores Briefly

A better credit score and lower rates are obviously beneficial to you and your family, helping you save money as you’ll be paying lower costs over the life of your loans. It may also offer up increased and more favourable options when you’re looking to rent a home or buy a vehicle, as an example.

Knowing your credit score, how the score is derived, and what factors influence it can give you the knowledge and tools to improve it. Borrowell can help you accomplish this through free Credit Monitoring, weekly updates and coaching, to help you stay on top of your score early and often.

Won’t Checking My Credit Score Hurt it?

Referring back once again to the Credit Scores Explained article, there are two types of credit checks or “hits”: hard inquiries and soft inquiries.

When you check your score with Borrowell, it’s considered a soft inquiry and won’t hurt your credit score. By only checking your score, you aren’t harming it. On the other hand, a hard inquiry will potentially bump your score lower (not always), but this will generally only happen when you actually apply for a loan or credit through a bank or other lender.

Is Borrowell Safe?

Borrowell states that they use advanced 256-bit SSL data encryption. They also mention that they won’t share personal details with unauthorized third-parties or initiate transactions without your consent. If you need further assurance, 1.5 Million Canadians have been provided free access to their credit Scores using Borrowell.

How You Can Use it to Improve Your Finances

So as we touched on, simply knowing your credit score is one of the first and most important factors. Being conscious of where you stand and where you would like your credit score to go.

Once you understand the factors that influence your credit score, you can further manage your finances and credit in a way that helps build your credit rating over time. Doing so will help you save money long term by getting the best possible rates when you go to borrow money.

Besides the free credit score and report, Borrowell has many other integrated tools and features that will help you strategize and guide you in improving your credit.

I signed up myself recently, so let’s dive into the process.

Borrowell Sign Up Process

Let’s face it; nobody likes filling out long forms, doing paperwork or other tedious, menial tasks. I come bearing good news – the Borrowell sign-up process is short, sweet and not at all annoying.

There’s no crazy information you need to hunt down when signing up, and you can complete the entire process in about 3 minutes! Probably less than two if you’re even remotely an Internet ninja of any sort. Try it, I dare you…

All that Borrowell needs are the basics. Your name, address, date of birth, phone number – vitals to verify your identity and match you to your credit file. You then verify your account with a couple of simple questions that only you would know about your finances, such as where your mortgage resides or what was the last credit card you signed up for. The image below walks through the main steps.

Yep, it’s that easy. Once you’ve filled out your basic details and verified your account, you’ll immediately have access to your credit score and credit report from Borrowell via Equifax. You can also do this through the Borrowell App on your phone through Google Play or the iOS App Store.

Borrowell Free Weekly Credit Score Update

One nice thing about the Borrowell website or app is that it provides you with weekly updates on your credit score changes. As mentioned, I keep hammering away at this one, tracking your score is important when trying to improve it. It can provide helpful hints on what events are having positive or negative impacts on your score.

Remember, it’s important to have a healthy credit score when applying for things like financing a new car, renting a property or taking out a loan. Borrowell’s tracking and monitoring is one feature that can help you in this regard to improve your score to potentially get better financing rates.

Financial Product Recommendations

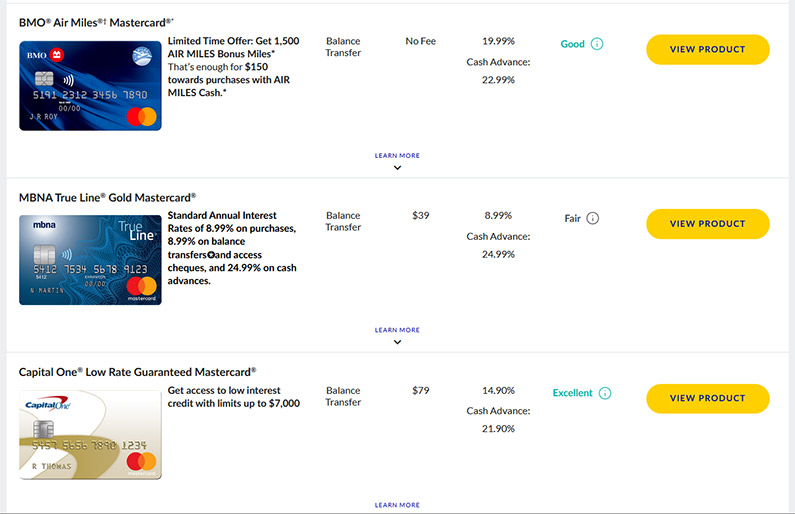

So by now, you’re probably wondering why this service is free. What’s the catch or what’s in it for them? Well, to put it simply, Borrowell offers financial product recommendations to its users. And they most likely receive an incentive for recommending such products if you end up signing up for such.

The brief questions you answer during the sign-up process, along with your credit report, help Borrowell to understand your goals and needs. This allows them to recommend the right types of credit products and products that you will likely have a higher chance of being approved for.

While this may be the case, I found the product offerings to be somewhat relevant and intriguing. Some were decent such as the high-interest savings account recommendations. I also thought it was cool that they list which credit cards you have the best chance of approval or are not eligible for. Knowing this potentially saves you time wasted applying for products you won’t be accepted for. When it comes to the loan offers, to be honest, they weren’t that great, and you can find better rates elsewhere.

Faster Sign Up and Approvals

One helpful feature if you do find a product you’re interested in, is that Borrowell has seamless integration with some of its partners. This feature will benefit you as it can make the application process much quicker since you won’t have to fill out personal information multiple times. Borrowell pre-populates details in applications for faster and easier submissions.

Molly, Your Borrowell Credit Coach™

So here’s one feature that I really love for people that want to improve their credit scores but don’t feel like reading pages upon pages of material on the ins-and-outs of how credit scores work.

Molly (your Credit Coach) looks like one of those annoying Chat Bots you see on the side of a website, except she’s much less irritating and actually helpful in most cases. The Credit Coach™ page on the website gives you a quick overview of your credit profile, broken down into three areas, Credit Score, Credit Updates and Improve Your Score.

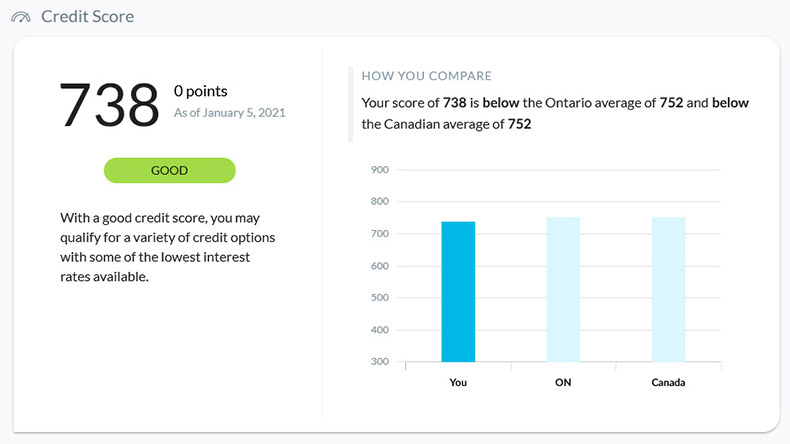

Credit Score

The Credit Score area provides you with your Equifax credit score and a general rating (“Good” in my case), and a comparison to others in your province and Canada.

Credit Updates

The Credit Updates section is a notification feature that alerts you when there have been updates to your credit report. Changes such as new inquiries, missed payments, along with messages to inform you if you are making the right choices with your finances.

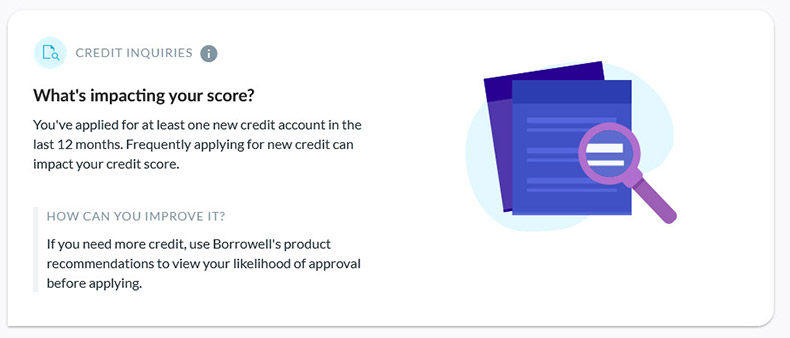

Improve Your Score

The Improve Your Score section provides suggestions as to what is impacting your credit score. Below each example is a tip, which attempts to provide helpful input on how to improve specific issues affecting your score.

Overall, the Credit Coach™ is definitely a nice feature if you’re looking for a way to easily monitor your credit, analyze your credit report and receive useful tips to improve your score.

Borrowell Boost

One thing that can largely impact your credit score is missed payments. Apparently, Borrowell members with only one missed bill payment are reported as having credit scores 150 points lower than people who make all their payments on time. That’s pretty interesting and shocking at the same time. Borrowell Boost looks to help solve this problem.

The purpose of Borrowell Boost is to track and then predict your upcoming bill payments. The primary goal is to help you NOT miss any payments. Borrowell offers this service of an interest-free $75 cash advance to help you avoid missing payments and getting charged overdraft fees.

The service securely links your bank account to predict upcoming bills and help protect your score from those momentary lapses. We all get busy; life gets busy. The idea here is that your credit score won’t suffer long-term (or your wallet) for that one temporary moment of amnesia.

My advice is always to try to pay your bills early and on-time. With the current interest rates, the amount of additional interest you’re going to earn in an account by waiting until the last minute to pay a bill is almost nothing. So get your bill payments out of the way as soon as you receive them and so you don’t forget. Better yet, just set up automatic payments whenever possible.

Borrowell Mobile App

Essentially it has all the same features of the website, including free access to your credit score (updated weekly), access to product offerings and customized recommendations as mentioned.

You also get personalized support and tips from Molly, the Credit Coach™ and Borrowell Boost.

Credit Score Differences

One interesting thing I noticed when checking my credit scores was that there seemed to be a large discrepancy between my Borrowell score (provided by Equifax) and my TransUnion score. A whopping 120 points!

This CBC Marketplace article “Why 4 websites give you 4 different credit scores…” demonstrates the same problem. Three people check their credit scores at CreditKarma, Borrowell, Equifax and TransUnion with confusing results.

It turns out that they all have their own slightly different methods of coming up with your three-digit score, and that score is not necessarily the determining factor in getting approved for credit products. In fact, the lenders typically use your FICO score, which is not actually available to consumers.

What’s the Point?

It’s a good question. If these numbers don’t mean much, is there really any point in monitoring your credit score? Well, yes and no, I’d say.

While the three-digit number may not carry the weight you might think, the average of these, plus your actual credit report and the items within it, will at least give you a fair idea of where you stand.

Some takeaways… when it comes to loans, lenders are looking at way more than your score. Factors including your income, past payment records, current credit available, utilization and credit history are determining factors. Lenders are examining these analytically and as a whole, versus simply relying on an algorithm that generates a representative score.

A big key with free products like Borrowell is that they actually give you access to this information, so you aren’t totally in the dark. You can still see what you are doing right and what you are doing wrong – and monitor those impacts on the score provided. Exact representation or not, it still helps move your credit profile in the right direction, not to mention it’s free.

Conclusion

To summarize Borrowell, it’s hard to argue with a free service. While there may be product offerings within it, you are under no obligation to sign up for anything.

There’s no harm in checking your credit score with Borrowell, perhaps to satisfy your own curiosity, or even better, to monitor and improve your credit. The website and app do offer some good features in that regard at no cost.

I also actually found this the easiest way to check my Equifax score, and not having to pay was a bonus. Otherwise, I probably wouldn’t have even bothered.

It’s a wonderful free tool, so if you’re looking to monitor your credit score and improve it over time, Borrowell is an easy option to help you accomplish that goal.

This was an excellent, detailed review of Borrowell! I’ve used their service for a couple of years and appreciate how user-friendly it is.

I agree with you—even if the numbers aren’t necessarily accurate, it’s a close-enough snapshot of your credit worthiness.

I think it’s better to have fuzzy numbers to keep track of your score than none at all!

Thanks for reading Chrissy, and yes even if it’s not totally accurate, I’m usually quick to check things out when my score has changed at all. I’m always curious to see what caused it to change.

Neither of the 3 credit score service providers provide accurate rating. They’re are only accurate as per the factors they measure. Thanks for the review.

That’s fair, however, they are used as a guideline, particularly for those who have no clue where their credit rating falls. Also for the purpose of tracking progress in either direction based on borrowing and repayment habits.