I keep a few different savings accounts, and with the current Interest rate environment, the interest rates on savings account are pretty pathetic, to say the least. A quick rundown…

- My first, which I’ll call my “Green” savings account, is offering 0.01%.

- Next, my “Blue” savings account is slightly better, at 0.025%.

- Finally, my normally higher (in comparison) “Orange” account offers a whopping 0.15%!

Savings accounts are not exactly what they used to be. With that said, there are other options like GIC’s, but I don’t currently want to lock my money in the long term, for example, 6 months or more.

The solution? I went online to investigate some other High-Interest Savings Account options and discovered EQ Bank.

EQ Bank – High Interest, Here I Come!

Most people haven’t heard of EQ Bank (I hadn’t), so I’m reviewing this experience, not as a “fan” of the bank, but as a new client. The first thing I wanted to investigate was the legitimacy of where I was depositing my money. To start with, EQ Bank is a virtual bank, so that fact may turn people off who are not computer savvy, or simply because they can’t see physical bank branches anywhere.

There can be the peace of mind in going to a physical branch location and dealing with someone face-to-face. For this reason, I would guess EQ Bank is more targeted to a younger audience. However, with that said, I have relatives who are seniors that use EQ Bank regularly.

EQ Bank’s Savings Plus Account interest rates have also been consistently high among peers, which could breed skepticism as to why they can offer such high rates in comparison to other larger institutions.

This is understandable, but the platform seemed to have great reviews – so I figured I’d check it out.

EQ Bank has also recently introduced TFSA and RSP savings accounts with great interest rates. This is wonderful news for savers, as it is likely the current TFSA and RSP rates will remain in effect, rather than similar “promo” rates from other banks that drop after 90 days.

Investigating EQ Bank

Who Exactly is EQ Bank?

So it turns out that EQ Bank has been around since January of 2016 and is based in Toronto. While they don’t have physical branches, EQ Bank is a trademark of Equitable Bank. If you haven’t heard of Equitable Bank, they are Canada’s ninth-largest Independent Schedule 1 bank and have over 900 employees.

Is EQ Bank Safe and Secure?

Yes! Equitable Bank is a member of CDIC, the Canadian Deposit Insurance Corporation and your funds are secure. What this means is that your deposits are eligible for deposit insurance up to $100,000 within your individual savings account, EQ Bank GIC’s and deposits in your name with Equitable Bank. Knowing your funds are insured by CIDC definitely instills confidence.

How can EQ Bank make money?

This is a valid question, and you would wonder why EQ Bank can offer such high-interest rates compared to larger competitors. For starters, EQ Bank cites that they can reduce operating costs and keep them low simply by not having physical branch locations and the associated expenses. This makes total sense to me.

If you go through their website, you will also notice a limited number of accounts and product options you can sign up for. Mainly their Savings Plus Account, Joint Accounts, GIC’s and International Money Transfers. Currently, there are no Business Accounts offered. EQ Bank has, though, recently launched RRSP or TFSA options, which is great news! I’m just speculating here, but a simple and uncomplicated product lineup likely contributes to the low operating costs through lower administrative and regulatory expenses for EQ Bank.

EQ Bank Offerings

Savings Plus Account

Are you ready for up to 30 times more interest than other banks? No monthly fees, free transactions and cheap international money transfers? EQ Bank’s Savings Plus Account touts these features to go along with the high everyday interest rate.

Here are some more features of the Savings Plus Account:

- High Interest Rates

- Zero Minimum Balance

- Zero Everyday Banking Fees

- Free Electronic Fund Transfers

- Free Interac e-Transfers®

- Free EQ to EQ Bank Transfers

- Free Bill Payments

- Cheap International Money Transfers

- $200,000 Maximum Balance

The Savings Plus Account is a great option if you want quick access to your money and don’t want it tied up in investment products. The interest rates have been consistently high, and no minimum balance or fees is a big plus.

Many other banks have accounts that offer high-interest savings, but they are usually short-term rates or require high minimum balances to avoid fees. The only downside I can see is the maximum balance of $200,000 – but at the same time, it is generally a good idea to spread your savings around different accounts to ensure the deposit insurance covers your money.

Joint Accounts

- Same High Interest Rates

- Quick Online Sign Up

- Add Up to 3 People

Joint accounts offer a great way to add a spouse or another family member, such as a parent or sibling. You can do it extremely quickly and easily through EQ Bank and enjoy all the benefits of the EQ Bank Savings Plus Account.

EQ Bank GIC’s

EQ Bank also offers High Interest GIC’s (Guaranteed Investment Certificate) that allow you to lock in your interest rate and guarantee it for a set period of time. They offer anywhere from 3-month to 10-year terms.

Click here to view the Current Featured Rates!

International Money Transfers

If you’re looking to send money Internationally, EQ Bank and TransferWire offer this service at a much cheaper rate than most financial institutions. You are charged for the transfer and pay the real exchange rate, whereas other institutions may inflate the exchange rates or have additional fees from the receiving bank. The bottom line is, EQ Bank offers cheaper International Money Transfers and displays a table of estimated fees and how they compare to other financial institutions when converting various currencies.

Transfers are easy to send from your savings account and should arrive within 3 business days. Daily limits are in effect, and you may transfer up to $9,500 every 24 hours.

Referral Program

EQ Bank also offers a reasonably generous referral program for its members. You will be paid a referral bonus for signing up new clients upon them meeting the signup requirements. The new client will also receive $20 credited to their Savings Plus Account for being referred to EQ Bank.

The referral bonus isn’t as large as some other banks offer, but the requirements are much less onerous. There is no large minimum balance required to be deposited, nor do you have to do anything, such as setting up bill payments or payroll deposits with EQ Bank to get your referral bonus. The referred individual only needs to open EQ Bank’s Savings Plus Account using a valid referral link and fund their account with a minimum of $100 within 30 days of account activation. Pretty easy, right?

Now before you start emailing 100 friends, there are some rules and limits on the referral bonuses. The bonus dollar amounts are tiered based on the number of referrals, and you can only refer up to 15 people and still receive a referral bonus.

Here’s a quick summary of how that is broken down:

| New Clients Referred | Referral Amount | Total |

|---|---|---|

| First three (3) | $20 | $60 |

| Fourth (4th) to seventh (7th) | $30 | $120 |

| Eighth (8th) to fifteenth (15th) | $40 | $320 |

| Sixteen (16) and beyond ($0) | $0 | $0 |

| Total Referral Bonuses | $500 |

As you can see, it pays to refer people to EQ Bank!

My Sign Up Experience

Since I was looking to earn more interest on my savings – I decided to take the plunge with EQ Bank’s Savings Plus Account.

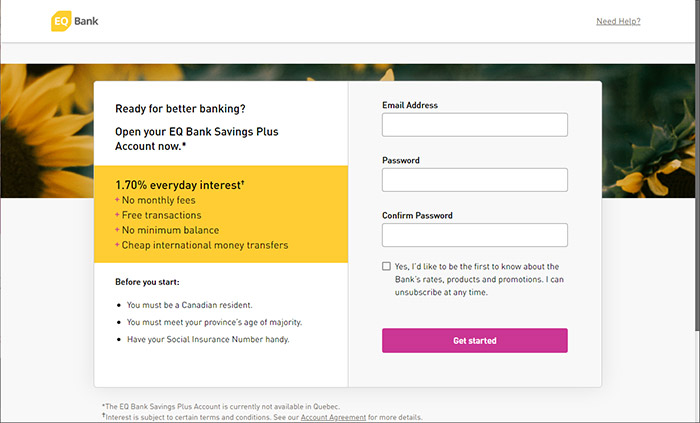

I found the EQ Bank website very straightforward to use and functional throughout the signup process. Clearly, a good amount of effort went into creating a visually appealing website that is also uncomplicated to navigate. The first screen doesn’t overwhelm and asks for only your email address and a password, plus the option to sign up for EQ Bank email updates. I assume this process will get you into the database so they can follow up with you, for example, if you decide not to complete the entire sign up process right away.

Next, they wanted all of my personal details. While the bank obviously needs this information – it was easy to fill out, and I didn’t find it cumbersome. The fact that there didn’t seem to be any unnecessary questions or steps that appeared as they were just gathering additional data is comforting. Just enough details to set up your account and verify your information.

Finally, you’ll be asked what your planned purpose is for using your new account. The bank collects this information to ensure your account remains compliant with government regulations. At the same time, perhaps this also gives them a little extra data to target you for specific promotions you might be interested in, such as GIC’s or Bill payments.

This last screen also has a helpful link to the CIDC brochure, so you can familiarize yourself with how deposit coverage works, what’s covered, your coverage limits, tips to maximize your coverage and more.

Now that they have all of your important details, the final step is to transfer some money into your new account.

EQ Bank allows you to link up to 10 different bank accounts from various financial institutions, which is great! It also gives easy access to authorize and link your existing accounts, similar to the process when you send an Interac e-Transfer® or make a bill payment online and choose your financial institution, as seen below.

Note that you can also skip this step at the bottom if you aren’t ready to link your accounts or transfer money in just yet. I chose to link my Tangerine Savings Account, as they usually have very good interest rate offerings but were only paying 0.15%. EQ Bank’s Savings Plus Account rate was 1.70%*, so much higher at the time. (Note: Savings Plus Account Rates have changed since to 1.50%* – If you are looking into other savings options in registered accounts, EQ Bank is offering 2.30% for TFSA Savings Account.)

It was pretty effortless to link the accounts, just by signing in as you normally would to your online banking, and then choosing the accounts you wanted to link by checking them off. Amazing!

The final step in the process was to verify my email address, and my application was on the way! It said I should hear back in about 3 to 5 business days.

I have to say, joining EQ Bank was one of the easiest signup processes I’ve completed for online banking. I believe your information is verified through TransUnion (and I’m sure EQ Bank does some checks on their end). The entire process took me about 5 minutes, including linking my other bank accounts and verifying my email.

Sure enough, I heard back from EQ Bank three days later that my Savings Plus Account application was processed and approved. I was greeted with a friendly welcome email inviting me to sign in and start using my new EQ Bank’s Savings Plus Account. It also explained the options available to get started by transferring money into my account. This was very helpful, as I’ve had other bank accounts that were fairly easy to set up but not always easy to get external accounts linked and move money into them.

After logging in to my account (and since my banking information was already linked) I decided to try out the transfer process. I’m pleased to report it couldn’t have been easier.

I selected one of my pre-populated accounts from the signup process, along with the EQ Bank account that I wanted the money deposited in, and voila! A day later, the money was showing in EQ Bank (not necessarily accessible as there is a hold period – but it was there!).

I’ve also tried transferring out of EQ Bank, and the process was just as quick.

The account page showing my newly deposited funds is well laid out, simple and efficient. Your accounts and GIC’s show up in the summary with expandable tabs, and all important features such as bill payments and money transfers are easily accessible buttons above. Overall I was very pleased with the user-experience – a modern but not over-the-top accounts page.

Some Hiccups Along the Way

Although the joint account is an option, my wife wanted to sign up for her own savings account. For some reason, her information could not be verified during the signup process, as EQ Bank uses TransUnion to validate information on the account opening form.

I contacted EQ Bank via their chat to see if there was anything that could be done. My request was picked up and answered almost immediately, which is always good. So A+ for the speed of customer service – however, I was told there was nothing they could really do on their end. My wife would have to contact TransUnion regarding any potential discrepancies that caused the verification error.

There was an automated process on TransUnion’s website to verify account information, but that seemed to fail as well, so we will likely have to phone them and just have not had the time.

This was the only stumbling block when trying to open EQ Bank accounts, but I could see how people would become deterred and not bother completing the process if more steps and phone calls make it become more of a hassle. However, if your information and application is verified immediately as mine was, the process was incredibly swift and simple.

One other minor issue I ran into happened when setting alerts. I received a notification in the EQ Bank Message Centre stating, ‘the alert for “Your bank statement is available” will no longer be available’. This message prompted me to check the status of my current alerts.

The only problem was that when I went to update them, I got an error message, and the changes didn’t seem to take effect. I will follow up with EQ Bank on this issue – perhaps it’s a glitch due to the recent changes to the alerts.

Summary

Pros

- High Interest Savings Accounts

- No Monthly Fees

- Free Transactions

- Fast Sign Up Process

- Good Referral Program

- Cheaper International Money Transfers

Cons

- Time-consuming sign up process if the information isn’t initially verified

- Maximum balance restriction ($200K)

- Must be a Canadian resident & age of majority in your province

This post may contain affiliate links, for which I may receive compensation.

*Interest is calculated daily on the total closing balance and paid monthly. Rates are per annum and subject to change without notice.