Have you ever wanted to track your budget without overcomplicating things? Maybe you don’t want to put all of your data online for security concerns, or bother with an app like YNAB?

Have you ever wanted to track your budget without overcomplicating things? Maybe you don’t want to put all of your data online for security concerns, or bother with an app like YNAB?

Some of us are still simpletons and prefer the tried and true excel spreadsheet method for tracking our finances. Below I’ve provided a link to my Family Money Saver FREE budgeting spreadsheet. I’ve used this for years to track my own spending habits.

Below the download link, you’ll find my category breakdown along with a brief explanation of each. You can, of course, feel free to add/delete, modify or adjust the spreadsheet as you see fit to meet your needs.

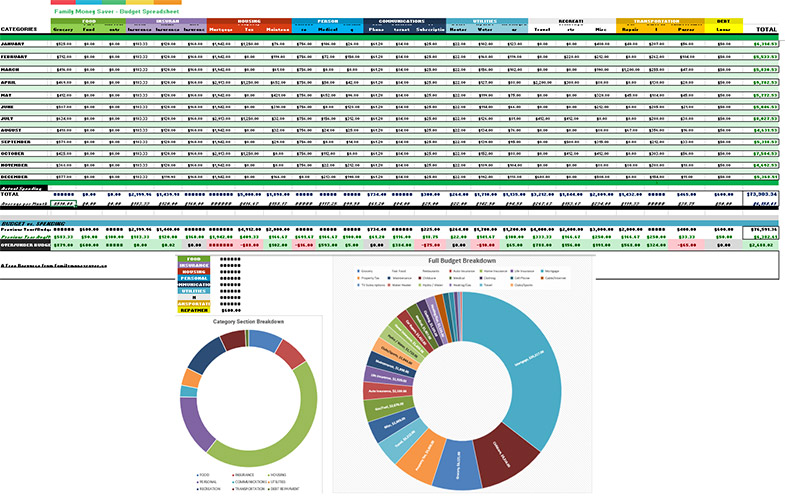

I think this Annual Budget Spreadsheet is a great starting point if you don’t already have one. It allows you to:

- Track Monthly Expenses by Spending Area

- Track Spending on Specific Categories

- Get a Total Annual Spending Breakdown plus Visual Graphs

- Compare to your Current Budget or your Actual Spending from the Previous Year or Pre-Defined Budget

Included in this file is a blank budget spreadsheet as well as an example, a filled-out spreadsheet.

BUDGET CATEGORIES

FOOD

Grocery

This category I try to use mostly for standard grocery expenses, such as food and essentials like toiletries, basic cleaning supplies etc.

Fast Food

The fast food category I reserve mostly for things like drive-thru food, pizza, subs and quick convenience meals.

Restaurants

The restaurant category I use for proper sit-in dining type restaurants, pubs, bars and other establishments.

INSURANCE

The costs for insurance and types can vary a fair amount depending on a number of factors. For my basic spreadsheet, I try to separate our Home Insurance, Auto Insurance as well as Life Insurance. While generally fixed costs, separating these categories lets you keep a running total so you can examine where you might be paying too much for a particular type of insurance.

Auto Insurance

Our car insurance is a fairly predictable expense and generally goes down slightly each year as our vehicles’ age or driving records improve.

Home Insurance

Home insurance is also fairly predictable but generally increases slightly every year. Many people combine their home/auto policies for discounts, but I like to track the two as separate items so I can compare prices if rates creep higher.

Life Insurance

This may not be in everyone’s budget, but you might have some other type of insurance policy as well, such as mortgage insurance. These are expenses that may potentially be reduced as you pay off your home or become more financially secure.

HOUSING

Housing is generally the largest expense for most and a big chunk of your overall budget. I break down our housing group into Mortgage Payments, Property Taxes and Home Maintenance.

Mortgage

Most homeowners’ biggest expense by far is the mortgage. This category can also be swapped out for Rent if you don’t own your home or prefer to rent.

Property Tax

Another fairly fixed, but generally slowly rising cost each year as property values increase. Property taxes may be paid monthly, quarterly or be lumped in with your mortgage payments. I like to keep this as a separate category so I know what the ongoing costs are since you will still be paying property tax even when you have no mortgage. Renters can cross this expense off the list.

Maintenance

I consider this category as anything that relates to regular home maintenance, repairs and minor renovations. I like to keep a separate savings budget for any major ‘unnecessary’ renovations or home improvements, this helps separate wants vs. needs in the budget. For home maintenance, I would include large ticket items like replacing a roof, windows, etc. but not something like remodelling a bathroom.

PERSONAL

Childcare

In this category, I include any childcare expenses such as daycare providers, after-school programs and babysitters. It can also include things like summer camps if the primary purpose of the program is childcare.

Medical

I use this category for out-of-pocket medical expenses like dental care, prescription drugs, eye care, vaccinations, hospital bills etc.

Clothing

Pretty much what it says, any clothing items, jackets, shoes, pants, shirts, socks, work clothes all end up here.

COMMUNICATIONS

Cell Phone

I include all of our personal cell phones in this category and would also include things like extra data plans for tablets.

Cable/Internet

This category is essentially our cable bill, which previously was Cable TV / Internet / Home Phone but now consists of only Internet service.

TV Subscriptions

A newer category for me, with cord-cutting becoming more common, I decided to start breaking down subscription services into its’ own category. This includes anything such as Netflix, Disney+, Amazon Prime, Crave, Sports packages you might subscribe to.

UTILITIES

The Utilities section covers all our home essentials like our Hydro, Water and Home Heating. This category might vary according to your location or municipality and how certain services are billed or bundled.

Water Heater

Many people rent their water heaters (you should look into purchasing your own versus renting – a whole separate topic). This is a pretty standard utility bill for a lot of people in Canada.

Hydro/Water

These bills may be separate or lumped together depending on your utility provider. We have water and hydro in the same bill and keep it as a single category.

Heating/Gas

Our furnace is pretty common for heating types and uses natural gas. You might want to classify a heating category if you’re using gas, propane or a wood stove – although some may have this category lumped in with hydro if you’re using electric heat such as baseboard heaters.

RECREATION

Travel

This category is specifically flights, hotels, accommodations, car rentals – pretty much anything related to vacations. If we buy groceries on vacation or dinners, however, I try to just keep those items as normal food expenses, unless it’s some sort of expense dinner we’d never normally do.

Clubs/Sports

This includes things like kids’ sports and activities, adult recreation, leagues, teams gym passes, pool passes, fitness memberships etc.

Misc

This category is kind of a catch-all for “everything else” and could likely be broken down farther, but I tend not to bother. It includes things like gifts, miscellaneous Amazon purchases, books, toys, cash withdrawals, furniture, etc.

TRANSPORATION

Our transportation budget is really anything to do with buying, using and maintaining our vehicles including Car Repair, Gasoline, Tolls/Transit Passes. We currently don’t have car payments, so a car lease could be an additional transportation category, or may be lumped in or replace Car Repair/Maintenance.

Car Repair

All car maintenance and repairs are grouped in this category. Oil changes, tires, repairs, regular servicing.

Gas/Fuel

This category is strictly used for tracking our gasoline or fuel costs and nothing else.

Tolls/Transit

I use this category for toll highways, transit passes, parking passes and metered-parking.

DEBT REPAYMENT

This category I’ve left simplified but would be all outstanding debt payments or Loans you currently have not including your mortgage.

Loans

The loans category I generally break down into individual loans. You could include a car loan, personal loans, lines of credit, outstanding credit card balances, etc.

Instructions

- In the “Budget vs. Spending” section, input your Target Budget for each category or Last Years’ Budget Numbers in the “Previous Year/Budget” row.

- Every month, input your expenses for each budget category in the appropriate column.

- That’s it!

Spreadsheet example:

WOW! This is amazing. Thank you for sharing. However, I don’t think I want to start tracking our expenses. Too much work. When traveling is back, our expenses will be 30% traveling, 70% everything else.

Thanks! From the sounds of it, you guys have a pretty good handle on your budget and spending anyway and don’t need to track. This sheet is actually modified from what I use somewhat, as I really track more for business expenses than personal.

Really love this FMS! I wish I had this spreadsheet when I started out. Glad to see I’m not the only one separating fast-food spending from regular restaurant spending. One is a nice night out, and the other is a guilty pleasure!

Thank you. I agree it’s important to track your ‘real’ food consumption versus treats and dinners out, it gives you a good baseline number if you ever lost your job or some emergency came up that left you with a lower income.

I find it becomes more difficult to track spending now too with big box stores that offer one-stop shopping – grocery, clothing, pharmacy, toys…. all in one.