It’s a hard lesson when the markets enter a steep decline while you are fully invested. Or if you have the vast majority of your allocated investment dollars in equities alone. It speaks to the importance of diversification, meaning not only what you have in your stock portfolio, but also your broader investment strategy. When the stock market is hot, many asset classes get forgotten or fall out of favour, but it remains important to be well diversified to protect yourself. Multiple investment classes can usually soften the blow of a rapid market decline.

Below are 10 ideas for investment alternatives to the stock market, most of which I own or have owned at some point in the past.

Bonds

Good old boring bonds. Your investment advisor probably recommends you have a mix of stocks AND bonds in your portfolio and for a reason. Bonds are not necessarily exciting, but give you a predictable and fairly secure return on your capital. You are essentially becoming the lender and the bond issuer is obligated to pay you a fixed rate of interest plus the initial capital back at the end of the term. They offer lower returns but are not as risky as stocks. So, boring yes, but they do their job, collecting interest on your invested funds while keeping your capital relatively safe.

So how do you buy Bonds? Banks will let you purchase from a wide range of bonds including government and municipal bonds, investment-grade corporate bonds, high yield bonds and more. Hey, maybe they aren’t so boring.

It isn’t always easy for the average investor to invest directly in bonds, so there are also Bond ETF’s. These products allow you to add diversification and stability to your portfolio while lowering your risk profile. Bond ETFs are also much more liquid, for example, if you don’t want to commit to a longer investment term, and they will also have better pricing transparency. You can sell them when you need to and harvest the cash easily versus the direct investment alternative.

Canada Savings Bonds (CSBs) was another way you could keep your money safe by purchasing government-backed bonds. Maybe your grandparents gave you one as a gift when you were younger as mine did. I didn’t realize this until a short while back, but Canada Savings Bonds are actually no longer available for purchase as of November 2017. The Canadian government cites a decreased interest in these products along with high administrative costs. That and the government having better access to investment capital through other channels. This makes total sense, as the low rates offered on CSB’s can’t compete with High-Interest Savings Accounts that can also be liquidated more easily and at any time. Also, probably why I didn’t realize they were no longer available as most people likely don’t pay attention to them anymore with other options available.

GIC’s

GIC’s or Guaranteed Investment Certificates are similar to savings accounts but usually offer better interest rates. The enticing factor with GIC’s is that they’re safe investments due to being backed by the financial institution offering them. Financial institutions will have deposit insurance up to a certain amount depending on the province and the insurer (for example CDIC or DICO). The important piece is to know that your deposits are insured up to a certain amount and that your risk is also related to how much you trust that bank or credit union will stay in business to pay you back plus the interest. Are most of them likely to be around in 5 years? Yes.

With a GIC you are essentially lending the institution money for a set period of time and counting on them to repay you plus the interest. They are counting on having access to these deposited funds for a set period, so if you withdraw your money before the term expires it will result in early withdrawal penalties. FI’s (Financial Institutions) will offer GIC’s at different rates and terms, longer terms generally equal higher interest offered. GIC’s may also have minimum deposit amounts or have better interest rates attached to products with higher value investment requirements. So the same holds true that generally longer-term / higher deposit value = better return rates.

Also to note is that interest rates will fluctuate over time so it can pay off to spread your GIC purchases out over a number of years to average out your returns. This is called “laddering” and you can see a well-illustrated example of GIC laddering on Tangerine’s website. And remember that interest earned on your GIC’s is taxable if not held in a registered account.

High-Interest Savings Accounts

High-interest savings accounts are a great way to hold cash, particularly money that you would like to have easily accessible. They generally offer higher interest rates than typical savings accounts and are designed to park your savings for longer periods.

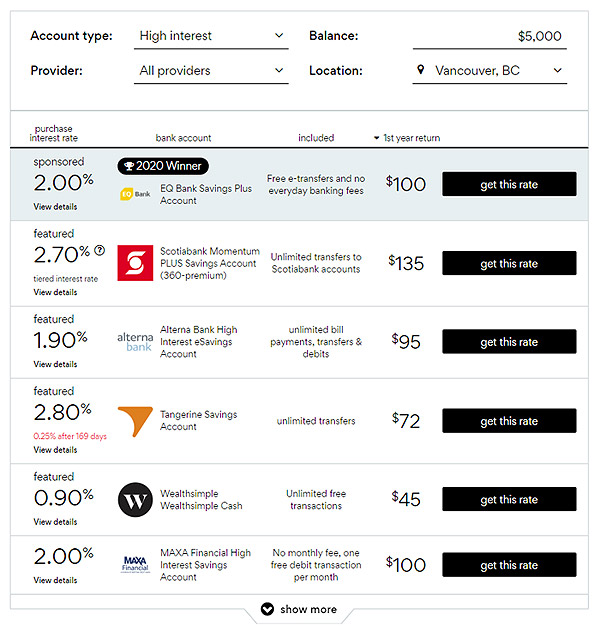

These accounts can have higher transaction fees than a chequing account, but that’s because their dedicated purpose is for saving and they generally don’t charge monthly fees. There are loads of options for where you can open a high-interest savings account. Ratehub.ca has a great tool that lets you compare current offerings and interest rates as you can see below.

Many banks and credit unions will also, from time to time offer promotional interest rate periods on new deposits into savings accounts. These can be a good short-term way to take advantage of great interest rates in an account you already have. The alternative is having to open a high-interest savings account strictly for that purpose.

Personal Real Estate

While over time real estate and stocks have performed similarly, personal real estate offers some diversification not to mention a roof over your head. The value of your home may fluctuate, but you can usually take solace in the fact that you will likely be there for a number of years and don’t necessarily have to concern yourself with such an assets’ fluctuation in value over the period.

When times are good, you may want to consider upgrading your home for the purpose of potentially selling and profiting in a hot market. Perhaps you are downsizing and want to unlock some of the value in your home. When doing any renovations for the purpose of profiting later, don’t lose sight of the money spent versus the potential return on investment. You must also weigh the benefits of what certain upgrades are worth in relation to how they add value to your life. For example, having a new kitchen, while living in a home you plan to sell in a year or two can enhance your quality of life and enjoyment for that time period.

Another factor to keep in mind when renovating your own home for the purpose of increasing value and then potentially profiting on a flip or multiple moves is moving costs. There is also something to be said for investing money in the maintenance and upkeep of your home. Doing things like general repairs, painting, landscaping and other “sweat equity” projects as simple as power washing your siding can maintain and even enhance the value of your home.

The best part about your home as long as you can afford it and afford to maintain it, is that it will serve its purpose through tumultuous periods of stock market uncertainty. While something like dividend income will potentially erode in a bear market, making your income portfolio less useful, your home will continue to serve its primary purpose. Make smart investments in your own home!

Investment Properties

Investment properties can be a great source of income and also a wonderful investment in terms of capital gains if you time the market correctly. There are so many types of investment properties to consider that it could be an article of its own.

Personally, I have been involved in residential investment properties, both rentals, renovation projects and a combination of the two. Generally, it has been a good experience, but definitely not all of the time. There are for sure hiccups and this is not an investment for everyone.

With rental properties, such as vacation homes and student rentals I have found solid screening, background checking where possible and basically just having good tenants is the key. You may be tempted or anxious to fill your rental vacancy as soon as possible, but in the long run this can be a huge mistake and can cost you time and money with the wrong tenants. There is also the time factor involved in managing your rental properties, which some may not want to deal with. You can always hire property management companies to do this, but it will of course eat into your profits.

While it might not be for everyone, investment properties offer some variety in your overall investment strategy with a potential income stream and capital returns.

Precious Metals

For some, it is an easy way to park your money in a physical asset other than cash. Gold is also generally used as a hedge during poor market conditions or when currency is losing value for whatever reason. I have purchased other precious metals in the past such as silver as well. I wouldn’t say these investments have done great by any means (timing is everything) but I did manage to make a little bit of money and luckily have not lost any. One other factor to consider is that gold and silver bars are just plain cool to look at and feel the weight when holding in your hand.

Gold, silver, platinum and other bars, along with collectible coins can be purchased online. A lot of people will buy them as collectibles or simply for the metal content along with the market value of these metals and the potential to increase in the future. It can be a fun way to invest in something other than stocks. In the past, I have purchased precious metals from places like Silver Gold Bull and collectible coins from the Royal Canadian Mint.

Collectibles

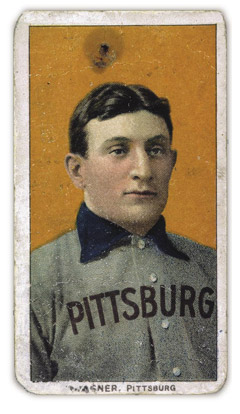

Coin collections, sports memorabilia, jerseys, trading cards, autographed pieces, fine art. You could probably list off a hundred types of collectible assets. A lot of times this isn’t the most lucrative way to invest your money, but as with everything else it can be a different storage of value and at times has yielded huge returns for some lucky (or smart) individuals.

I’m not a huge collector by any means, but I do recall once finding a rare photograph at a garage sale that I managed to sell on eBay for a whopping 7000% return. If only that was a common occurrence!

There’s also the famous Honus Wagner baseball card investment that Wayne Gretzky and former LA Kings owner Bruce McNall purchased for $451,000. The card had previously been purchased for 4 times its prior value before being sold again at a profit to Gretzky and McNall. They would then re-sell the card 4 years after their purchase for $500,000 as a contest prize. The card was again sold by the prize winner at a collectibles auction for $640,000 and then again and again changing hands among private collectors and topping out around $2.8 million dollars.

Not bad for a piece of paper. Maybe not the soundest investment idea, but definitely some outsized returns in this case.

Classic Cars

You would think old rich guys were blowing their money on a depreciating asset, buying classic cars or even modern supercars. This may be the case in many instances, but there is also a method to the apparent madness. Just like any other asset, luck, as well as forward-looking insight, can make you a winner in the game of collecting classic automobiles.

The fact is that many of these cars can be kept and driven for years and then sold for a tidy profit. Sometimes cars are purchased for that specific reason, other times the owners have purchased out of their love for the vehicle and eventually get bored and move onto the next car. These types of cars are less often purchased for the sole purpose of an investment, but they definitely can be and have garnered healthy returns for those with a keen eye, even when adjusted for inflation.

Take for example the classic McLaren F1 road car that came out in the early ’90s. A completely impractical, one-seat gas guzzler designed to mimic a Formula 1 race car. If I recall correctly, they were about a million dollars to purchase at the time. These prices remained in that ballpark or less up until around the mid-2000s, but then the interest in the car started to revive and it became more ‘collectible, ageing like a fine wine. At this point in time, these cars are being sold in the $10 Million dollar range! Quite a return on investment for someone who probably doesn’t really need the extra couple million in their pocket.

Now you may be thinking, nobody can afford these cars – but the same has held true for other lower prices vehicles even in the $50,00 – $100,000 range. Pricey yes, but still well within reach for individuals who wouldn’t be considered in the same circles as the super-wealthy.

Cryptocurrencies / Forex

With the advent of bitcoin, a number of other cryptocurrencies followed, such as Ethereum, Bitcoin Cash, Litecoin and literally thousands of others. The actual technology and utility value of each are more than debatable. In some cases, digital currencies or the backstories behind them look like outright scams or frauds. Companies set up for big IPO paydays, backed by celebrities and with the founders who promote the product only to disappear shortly after and never to be seen or heard from again. You have to be extremely careful.

Even with the most recognizable currencies, people have lost their digital “wallets” and are not able to recover their money. Even well-known and widely used exchanges have completely shut down or somehow “lost” customers’ funds in cyberspace, never to be seen again. When a common recommendation is to “never keep your money on the exchange” you can definitely question the security of your investment.

The fact remains though, many of these cryptocurrencies have had staying power over the years and the market capitalization is in the billions of dollars. Some still believe that bitcoins will be worth hundreds of thousands of dollars due to their finite availability. Others believe they will at some point be completely worthless. Only time will tell.

Cash

Having cash in the bank and knowing your money is safe and at least retaining its value (for the most part) is comforting. Or even better, earning interest for you in a basic account one of the safer investment products mentioned above like a high-interest savings account. That compared to what it would be worth in the form of equities in a bear market would definitely help me sleep better at night.

Conclusion

Overall, whether you choose to invest in gold, real estate or the stock market, I believe a key piece to keep in mind is not to overweight yourself in any single asset class. Just as you wouldn’t purchase only one stock or only one sector in the market, the same holds true for assets in general.

Don’t put all your supercars in one garage.

What was the photograph of? Good for you to know that it could be worth a lot and to sell it on ebay!!

I just have cash/ HISAS and real estate, nothing exciting.

I have an old $2 bill from years ago. I wonder how much that’s worth now 🙂

It was an old photo of Russian hockey great Valeri Kharlamov. HISA’s are actually exciting right now, given some accounts are offering a cool 0.05% interest rate 🙂

I have a few of those $2 bills as well, my guess is they’re worth about $2, haha.

I am new to investing and receiving dividends. I study all possible ways of investing. Thank you for sharing this information and your experience!

Great post. You should update your HISA link to come to my site rather than the boring Ratehub.ca lol.

I am thinking of real estate but not in Canada. Too hot and when you count in all the expenses (Tax, Insurance, etc) it won’t make much sense to me personally.

Wow, I just checked out the page, that’s a great chart you’ve compiled. I didn’t even know Canadian Tire has a HISA. I wonder if there website is offputting, honestly it looks like it’s a little sketch – like it hasn’t been updated in about 15 years. I wonder what platform they are running their online banking on, although I suspect I know the answer.

Real estate can be a good option but I agree, Canadian market is crazy right now, overvalued.

I invest in P2P’s. Lending Loop and Gopeer are Canadian. You can also invest in European P2P’s. There is also REITs not listed on the stock market like Addy invest, etc.

This is interesting and something I haven’t really looked at before. Thanks for bringing it up/mentioning it, I’ll be sure to investigate at a little to satisfy my curiosity at the very least.