Non-fungible tokens or NFTs are the latest craze in the world of cryptocurrency, Ethereum and digital trading. I really thought we had reached peak insanity when Bitcoin prices hit $50,000 USD, but it looks like I was wrong again! Welcome to the nuthouse!

If the crypto space wasn’t confusing enough already, with thousands of alt-coin projects, …hey, what the heck, let’s add digital collectibles or NFTs into the mix!

So what on earth a non-fungible token or NFT?

What is an NFT

A non-fungible token, as I understand it, can be many things but is essentially something that is considered a collectible item. The fact it is “non-fungible” means that it’s one-of-a-kind and cannot be exchanged for something of equal value – because it’s unique and therefore has its’ own value assigned to it.

Make sense? You’re probably scratching your head a little bit at this point… it’s confusing.

Pretty much anything can be ‘minted’ as an NFT. You could go draw a picture in MS Paint right now, upload it to a website and pay a few dollars in Ethereum to have it minted. Your token will be created and authenticated, representing ownership of your creation as the original work and voila – you have an NFT!

Where can I Buy & Sell NFTs?

If you are interested in buying, selling or creating your own digital assets or NFTs, you don’t have to look far. Lots of online sites are popping up, offering marketplaces to do all of this.

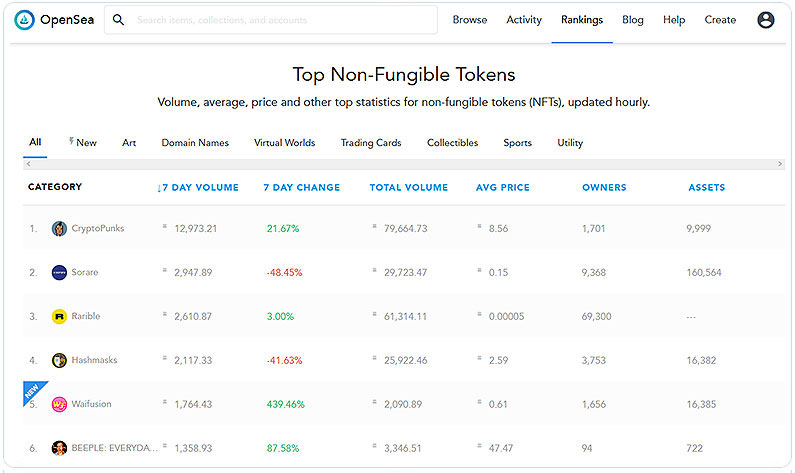

A couple of the most popular marketplaces are OpenSea (Buy Crypto Collectibles) and Rarible (Create and Sell Digital Collectibles Secured with Blockchain).

I’ve visited them both, and to be honest, it looks like a digital version of the Chuck E Cheese prize counter.

What Makes an NFT Valuable?

A recent example of this is a video clip of LeBron James, sold as a collectible licensed by the National Basketball Association under the brand “Top Shot.” This NBA collectible, which pretty much amounts to a digital trading card, just sold for $208,000!

Maybe I’m missing the point here, but in my humble opinion, this is borderline insanity. It appears to be a good reflection of the overall state of the markets and the amount of cash floating around. People are happy to throw money at basically anything, as long as they think there will be a quick profit on their investment.

Now with that said, the NBA Top Shots series is an extremely well-executed product and a first of its kind. It’s exciting to open digital packs of cards, just like when you open physical packs of trading cards, the surprise of seeing what you get. I just don’t understand the inflated values that some of these new ‘NFTs’ are selling for.

CryptoPunks – How Did NFT’s Start?

Cryptopunks claim to be one of the original or first non-fungible tokens released on the Ethereum blockchain in June of 2017.

What likely started as an interesting hobby or side project has evolved into a collection of major significance in the NFT space that has recently garnered lots of attention. CryptoPunks are digital drawings of punks (or other characters) that are limited to a release of only 10,000.

Each CryptoPunk was generated using an algorithm. No two characters are the same, and there will never be any more of them created, thus making them digitally scarce. The punks all have similar and unique features or characteristics, but some features are rarer than others. This makes some more ‘special’ or collectible. For example, most are “punks/humans,” but there are also 88 Zombies, 24 Apes and 9 Aliens. So you could assume an alien, being rare, would be pretty pricey (9 of 10,000).

Initially, when the project was new and posted online, these digital ‘punks’ could be claimed for free by anyone. Now they have been selling for tens of thousands of dollars, and in some cases, even more!

You can view details and sales history for each Punk on the website.

I’ve drawn my own unique CryptoPunk art below, which I’ll happily sell you for $10.

Cryptokitties

If you haven’t heard, Cryptokitties is a blockchain-based game that operates on the Ethereum network and lets you buy/sell and breed your very own digital cats. What’s not to love?

I’ll have to admit, the concept, the imagery, animations, storyline and everything about the game are exceptionally well-executed and impressive. That shouldn’t come as a surprise, as Dapper Labs produced it; the same company contracted to produce the NBA Top Shots collectible NFTs.

There have been around $40 million trading hands in the form of Cryptokitties to date.

Real-World Applications

So, what sort of professional or business applications might the technology behind digital punks and cats present? Well, investors have pumped a bunch of money into what is called the ERC-721 token standard. This is the standard that was used to develop prior mentioned NFTs, and investors seem to think the technology will have real-world use applications in the future.

Examples such as smart contracts between two parties for real estate transactions have been suggested as a scenario. In such a case, your smart contract would only allow funds to change hands upon certain conditions around the sale being met.

Maybe I’m clueless, but can’t you easily verify all of these conditions yourself before you sign on the dotted line?

- Is the buyer’s financing in place?

- Did the sellers leave the fixtures and furniture as agreed?

- Do all the appliances work?

- Is it the closing day?

Check, check, check… send the cheque!

Where is the need for a smart contract? Why do I need an NFT or some magical token to approve and validate this transaction as authentic? It seems that similar to Bitcoin and related blockchain technologies, we’re trying to find solutions to things that aren’t really problems to begin with.

Do you Hate Cats or something?

Hate is a strong word. I’d say I dislike cats but probably dislike digital cats and what they represent even more. Plus, you can’t pet them.

You might be wondering why I’m so skeptical or down on NFTs. The real problem with digital art or NFT’s is that you can simply reproduce them or save a copy of the piece instantly at any time. The only real (assumed) value is the idea or perception that you are the true owner of that collectible.

To the NFT collector, for some reason, it doesn’t matter that anyone else in the world can create a copy of their collectible. Or the fact that you own the token associated with that item, which is the only thing that assigns its value to you. It seems like one of the greatest scams ever.

I don’t get it.

So let’s explore the area of collectibles a little more to examine if ownership of a unique token, in and of itself, is valuable.

What Makes Something Collectible?

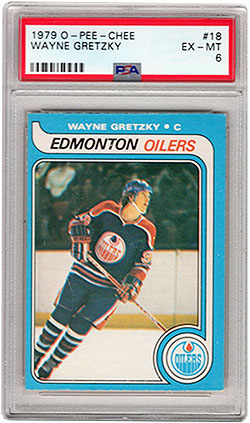

Investopedia defines a collectible as something worth more than it originally sold for, based on its popularity or rarity. It could be several items, such as baseball cards, rare toys, classic cars, artwork and more.

I can understand how being the first of its kind would make something like CryptoPunks and Cryptokitties unique and desirable. But will the NFT trend continue to support their perceived worth? Are these items likely to carry forward their high valuations into the future and become even more desirable as time goes on?

Trading Card Similarities

We have to remember that just because something is collectible doesn’t mean it will remain collectible or valuable. I have thousands of old baseball cards and hockey cards in my basement that are pretty much worthless. We used to buy these cards for fun, not generally because we thought they’d be worth millions of dollars at some future date. When they became valuable, we started buying more new cards, in hopes that they would become valuable too.

The problem with easily producible collectibles such as trading cards, similar to NFT’s, is when they suddenly become more valuable, the market gets flooded. Companies began printing excessive amounts of sports cards to cash in on the excitement from collectors.

NFTs & Art

Therein lies the problem. Anyone can produce artwork and make an NFT for it, but it doesn’t mean anyone wants to purchase it. Artists have struggled to sell their work for years. There are online platforms where you can sell your paintings, reproductions or prints, digital art and music. Technology has made it so much easier and cheaper to create artwork, but it is still challenging to sell any substantial amount of artwork.

In the art world as a whole, most creatives sell hardly anything. A tiny percentage of artists sell the majority of the work. They are skillful at their craft but also good storytellers or good salespeople. In most cases, they connect with the galleries and their representatives who are the ones that actually sell pieces.

Pricing in Cryptocurrency

There also seems to be a flaw in how many NFTs are currently valued. Most NFTs are priced in Ethereum – so what happens if the price of ETH plummets? Trying to value and price these digital assets for sale becomes increasingly difficult by tying them to a highly volatile cryptocurrency.

What Makes a Collectible Valuable?

So if most NFTs are worthless, what would make them valuable? The only case I can see a being made for something like CryptoPunks being valuable is the storyline behind it. They have a historical significance of being the ‘first’ and having a scarcity element to them in that regard. But they shouldn’t be worth anything near the valuations that are currently being assigned.

Why?

One of the reasons people value art is for their ability to display the physical piece. You can discuss its’ features and show off characteristics of its’ authenticity. You can point out textures of brush strokes on a painting, where it got damaged during a famous heist, where the artist hand-signed their name. The same characteristics can’t be attached to an NFT.

The Problem with NFTs

The problem with the majority of NFTs is the work they represent is entirely replicable and easily copied. You can’t just magically age a piece of canvas 300 years. The only thing supposedly worth anything is the fact you own the token.

I would define the traits of something that is genuinely collectible as:

- unique, rare or scarce

- commands interest from other collectors

- has historical significance

- cannot be replicated or easily reproduced

Compare that to a piece of rock taken from the moon, something you can not easily replicate. It’s a feat of magnitude to travel to the moon and back compared to drawing pixels on a computer screen. A moon rock is an extremely rare physical object that is tremendously difficult to obtain. Even meteorites are considered extremely rare and valuable, but apparently not as valuable as digital NFT artwork.

Tangible Versus Digital Items

Let’s revisit the LeBron James digital basketball card, a video clip of him dunking. Anyone can watch or save the video clip. Nobody is paying to watch the clip over and over. Is the play historically significant? Not really. Can you keep a copy of the clip for yourself? Yes.

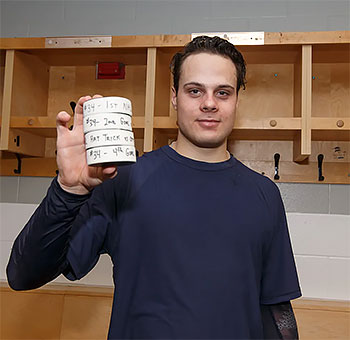

Compare that with this story, something I’d consider a true collectible.

A single player scoring four goals in a game is an extremely rare occurrence in its own right, let alone their first game ever in the league. It’s an accomplishment that will likely never be matched. The accomplishment carries historical significance.

The NFT Version

Now let’s use the NBA Top Shot NFT concept. We’ll pretend the National Hockey League has just minted the first Auston Matthews NFT – a digital video clip of him scoring the fourth goal that night and celebrating.

What would you rather own?

The only jersey in existence that he wore that night, the night he performed an ultra-rare feat while playing for a historically significant franchise? How about one of the four pucks he scored the goals with?

Or… would you rather own a few lines of code, a token representing ownership of a digital sports card, commemorating that moment? A clip that everyone else in the world has access to 24 hours a day, seven days a week.

And yet here we sit, at a time that someone would likely pay more for a digital token representing a moment rather than the actual memorabilia itself.

Hopefully, you see my point here, even if you’re not a hockey fan.

False Scarcity

I’d like to mention that many of these tokens are scarce only because we’ve designed them that way. Many trading cards, on the other hand, became rare over time, organically. Trading cards would get lost, damaged, faded, would be printed incorrectly.

In the past, you held onto rookie cards but had no idea how a player’s career would evolve or how long it would last. You didn’t know who would be stars or which cards would command more value in the future.

There is a disconnect here since it’s not the piece itself that is unique but the “token” that accompanies it.

And if you really want proof that you own a collectible, we already have physical versions of NFTs. They’re called COAs – Certificates of Authenticity.

The Case for Video Games

Another use for NFTs that I’ve heard of is for video games, which is one application that I can understand and at least appreciate where the value might come into play.

Video games are big business. There are tournaments, online competitions and big prize money. While I think it’s dumb to buy a digital item simply for the sake of having it, video games are an application that presents cases where digital items might be worth something.

A quick example is if you bought digital real estate – land or territory in a game that helped you earn money other assets in the game. A special weapon that gave you an advantage over other competitors. I understand how these digital items could translate to real-world value, in that they could potentially earn you more income from winning games. They might aid you in creating and selling other digital assets in a game that are of value and can be sold to other players.

This is similar to stocks in the sense that they can be valued for their income-producing qualities. They can generate a real return on your investment besides just their price appreciation based on speculative valuations.

However, like stocks, you do have to be cognizant of whether these items will remain valuable in the future, based on the popularity of said games, whether other items or realms become available or more valuable.

This is one area where I can at least make a connection between the scarcity of such digital assets and their monetary value.

Craze and Hype to Make Money?

The rise in popularity of NFTs also has people quickly taking advantage of the opportunity to cash in – like the NBA with their Top shots cards.

As mentioned, there are websites now dedicated to creating NFT of your artwork. All you have to do is pay a small fee in Ethereum since it uses ‘gas’ on the network to create the tokens. Creators of such platforms are smart if they’re able to skim a bit off each transaction and take advantage of the current popularity of NFTs.

Others are using their celebrity status to endorse or cash in on NFT artwork or collectibles. Take, for example, Logan Paul, a YouTuber famous for “unboxing” rare Pokemon cards. Yes, he opens boxes of cards in front of a camera. He’s sold NFT’s that I guess are representative of ownership of some of the unique clips associated with these famous unboxings, to the tune of 5 million dollars (about 2,500 at 1 ETH or roughly $2,000 each)

I’d consider this the scammy side of NFTs, that I don’t like. Are people buying any of these items for their collectibility or artistic value? Or just in hopes, they can resell the NFT later for more money?

Have you heard of an artist named Da Vinci?

How about Beeple? If your answer is no, you’re not alone.

Leading up to the online auction, one of his NFT artwork pieces has just sold for a whopping $6.6 Million dollars. And as of writing this piece, the auction has concluded with a sale of $69.3M.

In my opinion, Beeple has just won the lottery in a sense. He’s probably speeding off in his Ferrari Private Yacht, laughing his head off at these nonsense sale prices.

I’m still a little dumbfounded as to why ownership rights to a digital piece are worth so much money? Why not just sell the source file? Wouldn’t that be worth more money than an NFT representing ownership of the art?

Mainstream Acceptance?

Since this NFT has now been offered and sold by Christie’s, a seasoned auction house, people will argue that NFTs are gaining mainstream acceptance. The same could apply to the NBA’s Top Shot series being so popular – or is this just another fad that will quickly fade away?

I’ll guess the latter and counter that auction houses will sell whatever makes them money. If the current hottest trend nets them a huge commission, they’ll be more than willing to participate.

I’ve been involved in the art world and collectibles space for some time. I’ve even met the owner of a very prestigious, world-renowned auction company. These are businesses that make hefty commissions, so I can only imagine how enticing an on-trend digital piece such as this would be. Huge profit potential with low costs involved compared to other physical items they would typically be tasked with overseeing the care and marketing.

It will be intriguing to see how many NFT’s are offered and bid on going forward.

Conclusion

NFTs are not revolutionary. I’m not even sure NFT’s are art, but simply a Certificate of Authenticity in digital form, representing an accompanying digital collectible.

The naysayers will attempt to make you feel inferior by claiming you don’t understand the technology behind a non-fungible token, calling you names like “Boomer” or relegating you to a dinosaur of sorts.

I’ll argue that similar to Bitcoin, scarcity alone doesn’t make an NFT valuable. The lack of physical attributes and qualities also makes such collectibles less desirable.

Would you rather own a million-dollar classic car, a game-worn jersey, a 300-year old painting, a rare piece of geological history…… or a digital token?

Wouldn’t you rather have a genuine certificate of authenticity? The actual pen strokes belonging to a living and breathing artist that created the work, lines which can not be 100% replicated?

If you answered, “no” – give your head a shake.

I’m starting to feel old and dislike the Internet.

I’d rather own pretty much anything else that’s worth $1 million than a digital token. NFT is an interesting concept, but it’s hard to see how anyone except a small minority can make money from it.

One thing I don’t understand is how copyright is dealt with. What’s stopping someone from minting a picture of Mario or some other Nintendo based character and sell the NFT anonymously? Same goes for any intellectual property. Why not create an NFT from existing art and sell it for personal profit? It seems like there is a gray area here.

I agree 100%. There’s a fine line with artwork of all mediums in terms of what’s acceptable use and what is subject to copyright. You’re getting into technicals too once you start trying to validate hashes for two identical pieces to see which is the authentic one or a certain number in a collectible series.

Physical items worth $1M can be lost, and devalued by damage. For, example, A diamond can be lost. An exotic car can get totaled, and paintings can get damaged. A $1M digital token is indestructible, and will always live on the blockchain after it’s minted.

Also just want to point out how instantaneous it is to sell an NFT around the world than it is, to ship say a Lamborghini across the globe.

To address the IP issue. NFT’s are used to authenticate the license or the original artist. We have a lot of licensed NFT’s now from company’s like Marvel, DC, Disney, Warner Bros, Nintendo. The list goes on. Joe schmo is missing this layer with their fake Van Gogh NFT.

Wow, another detailed post! It’s totally bonkers to me. I agree—it’s unlikely that NFTs will ever truly take off (aside from some one-off deals). As Liquid points out, there’s so much grey area.

And as you mentioned, anyone could go find the same video clip and watch it for free. The NFT version essentially just gives you bragging rights to say you own it. Is that worth hundreds of thousands of dollars? I definitely don’t think so.

It’s crazy!!! But it’ll be interesting to see how all this plays out.

Maybe it will settle somewhere in the middle, who knows! There are lots of physical art pieces, cars and memorabilia people pay atrocious amounts of money for.

Maybe the guy who just bought the 60+ million dollar NFT will make a big profit off it. Or maybe his money will just disappear into the ether…

I can feel the pain! Honestly, how did you feel while researching and writing about this?

I am amazed and astonished. I have read many articles about this non-sense but yours has been the BEST! Honestly, what you wrote is worth more than 99% of what they are selling on OpenSea.

PS. I minted 3 of my daughter’s drawings there. She kept looking at OpenSea and she was like, “Daddy, is this a garbage looking art gallery site?”

But hey, those who made millions from the Crypto craziness, will be more than happy to spend a percentage on this stupidity!

We will sit back and wait for the bubble to burst along so many other bubbles.

Thanks for the kind words.

It’s definitely irritating seeing people make off like bandits, just from trading less than stellar pieces of “artwork,” if you can even call it that. I’ve learned as I’ve gotten older however, not to get too bent out of shape over things you can’t control. It is nice at least to get some affirmation that I’m not alone in thinking this is crazy nonsense.

Hopefully your daughter sells something – if not, you can just buy it from her and keep it a secret. 🙂

This, like Bitcoin and its spawn is reliant on data. If the power goes out it’s worthless. SOL!

They also seem to consume a ton of power as well.

Your bank account is 100% digital. If the lights go out, your money is wiped just as easily. Bitcoin is decentralized across 100000+ computers around the world. It would take a lot more to wipe that out than a centralized bank that digitized your cash back in the early 2000’s.

Either way, if it all collapses, we go back to bartering for survival items. Gold and currencies will all be worthless. Bullets may become a currency though.

I just heard about NFTs a few weeks ago and suddenly they are all the rage. I feel like I am getting too old to be keeping up with this sort of stuff. Thanks for the explanation.

It will be interesting to see how this whole NFT thing plays out, that’s for sure! I’m curious how all of these ‘investments’ fare longer-term as well.

NFT’s are no longer just collectible jpg’s like cryptopunks. A lot, of today’s current projects are adding utility to NFT’s to keep the community engaged with their NFT’s. Other projects like Bored Ape Yacht club are scarce, and unique. Yes it is a collection of 10,000 but each one individually is 1 of 1. There is market demand for these, and that is what is driving the price. The fact that these are verified unique on the blockchain is what gives it value. It doesn’t matter how the quality of art is perceived, because there is no accounting for taste. Supply and demand drives NFT’s largely, not the quality of the art.

No edit button so just want to add:

History

1792 – Why would I put cash in the Stock Market? SM is garbage

1950 – Why would I get a credit card over cash? CC’s are garbage

2008 – What is bitcoin and why would I buy it. BTC is garbage

2021 – What are NFT’s and why would I spend that for a JPG. NFT’s are garbage

What’s the next thing that has a bright future folks won’t understand out the gate. We’ll have to wait and see.

Appreciate your input and perspective! It will definitely be interesting to see how these new technologies play out and evolve as the years go by. Which become valuable and which become obsolete!

There will definitely be winners and losers. Like any speculative investment.

I’m 42, and still a lot to learn. I’d like to think all the research I do on a project before I buy their NFT makes it a “safer” investment. I look for a solid model with great art (imo) and a good future roadmap. Currently there is high probability many folks will jump into losing projects, but hopefully there will be a learning and they are more careful with who the are giving their money to. First line of defense is don’t Buy NFT’s from an anonymous dev team.

My advice is to not spend money on NFT’s you can’t afford to lose.

Great write up, i’ve been pondering the same and largely agree. but another friend pointed out something that’s worth considering: the power of consensus. In other words, herd mentality, or common perception, is hard and maybe has value. The NFTs might be garbage, but if there is enough consensus, a large group of ppl all believing in it, then that in itself gives it value? like large group of ppl believing in God, or diamonds are rare(they are not). yes , it might be stupid, like a time when large group of ppl believe tulips worth 10,000. but society is stupid. the world works in a way that when most ppl believe in something that’s stupid and wrong, it can become right. so the question is, do you want to go against the herd? or take advantage of the herd. short term, there are speculative money to be made, money you get from later fools. long term, the tech might be even every where, but there will be much less chance to make money from other fools, it’ll be like the good old SHA256 encoding, everything will be blockchain encoded, but an encoded garbage is still a garbage. and I agree with you, virtual world is supposed to be cheap, free, physical world will be the luxury. Virtual world is supposed to meant for easy replication, adding artificial scarcity to something that’s meant to be abundant sounds contradictory. but again, if everyone believed it, what the hell.

A great perspective, it’s definitely an option to go with the momentum or herd play. If you are risk averse though, it may be better to invest in things you are more certain will retain value. To me, NFT’s are a little too ‘new’ and a little too trendy.

I agree mostly however the NFT market is booming but I think Metaverse will be even bigger thus with the NFT’s inside of the Metaverse technology is gonna be nuts within then next decade!

It will definitely be an evolving space and will be interesting to observe how things play out.

Spend your money on a new pair of socks.

What else will they come up with next to make money from basically nothing.

Good news everyone my name is Marta

Today if you need already programmed bank card

loaded with 200,000 euros

To activate and receive your card, kindly please contact:

paolodevera770@gmail.com

Thank you