I recently became bored I guess, of the cashback credit cards I’d been using for a few years now. The Tangerine Money-Back Credit Cards were great when they first came out, rebating you 2% off of three (3) selected spending categories of your choosing. (Or two (2) if you didn’t deposit your cash back into a Tangerine bank account). It was a decent amount of money back compared to the value of other cards. You could also take advantage by applying for two separate cards with your spouse or another family member to take advantage of the two separate cards and select 6 categories between the two of you. Obviously, make sure you trust that person as a secondary cardholder! But if you do… More cashback, excellent!

My Tangerine Credit Cards Earned Me Over $3,000 Cash Back!

Now, I can’t really complain, in fact, i was actually a little surprised when I checked my Tangerine cards cashback total and what had accumulated. I don’t really keep a running tab on my cashback earnings and I honestly don’t remember how long I’ve had these cards or how long I’ve been getting rewards on them. When I did last check, my Tangerine cards to date have collected $3,104.67 which is probably enough money to go on a nice trip. Some people might yawn at this total, but there are others who probably aren’t collecting anything of value at all on their cards.

This is however a good example of why I can’t understand why anyone would want to pay using a debit card. That is of course assuming you are responsible about how you are managing your credit. If you can pay off your balance every month, it’s a free loan with added benefits. The points simply add up over time and it’s free money.

Could I Earn More Credit Card Rewards and do Even Better?

I had been relatively satisfied with my rewards but then Tangerine started promoting their new Tangerine World Mastercard, They’ll probably get a lot of people to automatically switch over, which is smart as it’s easy to do – but for someone like me it just made me evaluate things a little more. I was also a little annoyed that they had changed their “All other purchases” cashback from 1% to 0.5%. That definitely takes some incentive out of the card.

After a bit of research into the new ‘upgraded’ card, I realized how much it was actually lacking in comparison to what I could be getting. To be honest, I probably wouldn’t even have bothered looking at other credit cards, but the new offer prompted me to start comparing. When I saw a number of much better cash back cards along with cards offering up to 10% cashback bonuses for the first few months or high rewards on certain categories like 4% on groceries and gas, it made sense to investigate.

So at the time I had been looking at cards, I casually mentioned some of them to my brother as he was telling me about a trip he had recently booked to Hawaii. I figured that was an expensive trip and he could probably take advantage of those bills by getting some decent cashback rewards. But then he kind of floored me saying he wouldn’t get much cash back because he had paid barely anything for his two-and-a-half-week trip… Huh?

Why Didn’t You Tell Me About This?!

Now, this is a topic that could cover another entire post, but he essentially started telling me about the travel rewards points and sign-up bonus points he and his wife had been jointly collecting from a number of credit cards. I think I vaguely remembered him mentioning it previously, but I likely just thought it sounded like a pain to keep track of more than one credit card, let alone 20… and just continued along with my two cashback cards. But, it was the almost FREE trip to Hawaii for 2+ weeks at world-class resorts that got me listening.

He started telling me about the wonderful world of sign-up bonuses. In short, get a new credit card with an introductory offer, meet your minimum spending requirements – receive bonus points and move on to the next one. It sounds too good to be true, right? And why would I want to risk damaging my credit score just to get a bunch of travel points? On the surface, this argument makes total sense to most people and is a valid concern, and it is a pain to track multiple cards for most people. But was it true that your credit score will be hurt by applying for or having multiple credit cards? And how many?

Will Having Multiple Credit Cards Hurt My Credit Score?

It’s a great question, and something you can examine for yourself after reading my more in-depth, Credit Scores Explained article. The conclusion is essentially that, as long as you are responsible with your credit and aren’t over-utilized, having a whole whack of credit cards isn’t really going to harm your credit score or creditworthiness. At least to such a great degree that you should be worried about it or avoid the “points game” or churning credit cards. The bigger key is that you are responsible in regards to how you manage your credit cards.

I’m definitely late to the points game as I have been collecting for over a decade, but my reluctance was probably two-fold. Not being knowledgeable enough about the potential prize at the end of the tunnel and just overall laziness. Lazy in the sense of not wanting to or having to deal with keeping track of multiple credit card balances, payment dates and sign-up statuses. But that’s where it all kind of ties into the big catch with this game…

There is no doubt that to ‘play’ this game you have to be extremely organized and responsible with your credit. Possibly even a bit of a Microsoft Excel nerd, to do it properly and effectively. It’s also something you have to have at least a semblance of interest in, or tracking on a multitude of credit cards will just become a huge hassle. If you start forgetting to make payments or which card you need to spend money on to hit bonuses at a certain time, thus losing said bonuses – it can become a bit of a mess and you’ll negate the rewards in interest payments. So fair warning, this game has rewards but also takes work and some time invested.

Trying it out for Myself

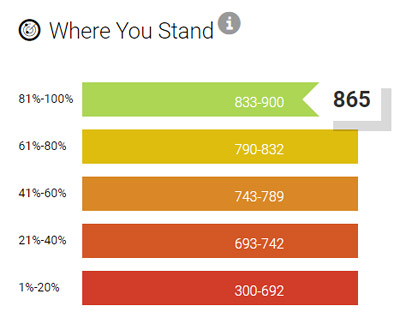

I decided to go for it anyway and enter the rabbit hole of points collecting and sign-up bonuses, taking a relatively cautious approach and monitoring things as I went. The allure of potential luxury rewards was just too much for me. My credit score was truly not a huge concern either as I felt it was in pretty decent shape. I also didn’t really need to apply for any loans or anything else in the foreseeable future that concerned me or that I felt my score would be an immediate issue.

Credit Score Guidelines & Credit Score Breakdown

So how does your credit score breakdown exactly?

-

35% | Track Record of Repayment

-

30% | How Much you Owe / Credit Utilization

-

15% | Age of Accounts

-

10% | Credit Mix

-

10% | Credit Inquiries

For a full explanation, read my article on how credit scores work.

Many when applying for credit have a huge concern that getting a credit inquiry on their file will result in a drop in their score. Some are even afraid just to check their credit score. While it is possible to take a hit to your score from hard inquiries, for example when applying for a credit card, it does not affect your score to the degree that people worry about the consequences. In fact, credit inquires only make up a small fraction of your overall credit score- track record and history of repayment along with your overall utilization are the bigger keys to maintaining a good score.

4 Months and 11 Credit Cards Later

Honestly, it seems a little crazy to me – something I never would have considered doing previously simply for worry of damaging my credit. I was still a little hesitant to try this out, even after doing a moderate amount of research (perhaps from just being skeptical and not trusting everything I read online). However, I have no immediate or medium-term needs for credit that I can envision, so I don’t really care nearly that much about my credit score as I used to.

At this point I have 9 new credit cards on the go and two older ones for a total of 11. I guess it’s safe to classify that as “too many” in most people’s minds, likely well above the average person. Again, thank goodness for Excel spreadsheets!

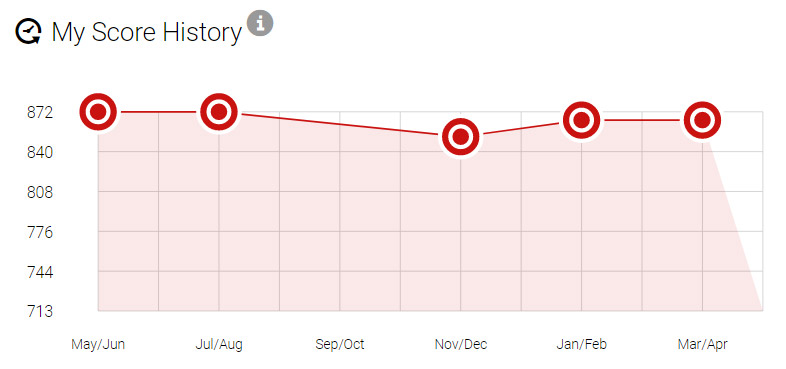

I haven’t really noticed a dip in my score of any great concern. The only blip I saw on the chart above I’m 100% sure about, but I’m going to attribute it to a $30K line of credit I drew temporarily to put in a high-interest savings account for a few months. (Tangerine was offering 0% interest on a LOC, so I took advantage and dumped it in a High-Interest Savings Account). After repaying that immediately it appears the score went back up. So I’m going to chalk that data point up to my ‘overall credit utilization’ category.

It was interesting to me just to watch the data, that I could apply for all of this credit, and why it didn’t hurt my score (yet). Will it in the future? And at what point? I guess the journey will continue.

Conclusion

I would have to say, if you follow the Credit Score Guidelines above in terms of paying off all your accounts on time as well as not over-utilizing your credit, you should be fine. At the same time, it is important to be proactive and monitor your credit score. This way you will be aware as soon as any drops to your score occur, so you can try to determine why and how to correct them..

I will post an update if I reach a point that the card collecting has impacted my score to any significant degree.

Hah, sounds like you and your brother are both financially savvy!

Which 9 travel credit cards did you apply for?

I recently applied for the CIBC Aeroplan.

Most are travel cards, but not all. Recent travel cards I can remember are CIBC Aerogold / TD Visa Infinite Travel / Amex Business Platinum / RBC Avion / Amex Marriott Bonvoy. Basically focusing on the best bonus offers with no annual fee. I didn’t bother with the Scotia Travel card and I have a BMO Cashback card, so may try to product switch that later on. I’m tapping out on new cards for a bit.